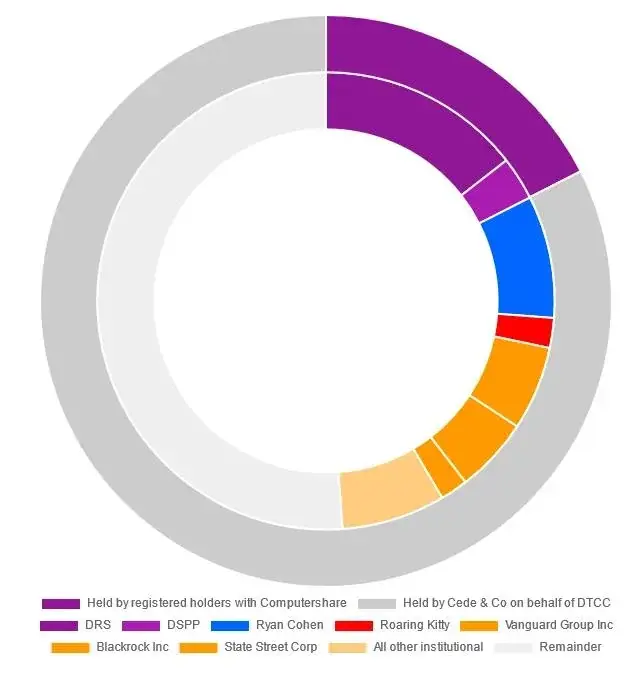

[images source ](https://gmetimeline.org/ownership) Institutional ownership increased from 87.4 M shares as of June 13 to 97.6 M shares as of June 30

jersan

3 months ago

•

100%

jersan

3 months ago

•

100%

🤷

🫡

# Ownership pie chart  # Ownership table  [images source](https://gmetimeline.org/ownership)

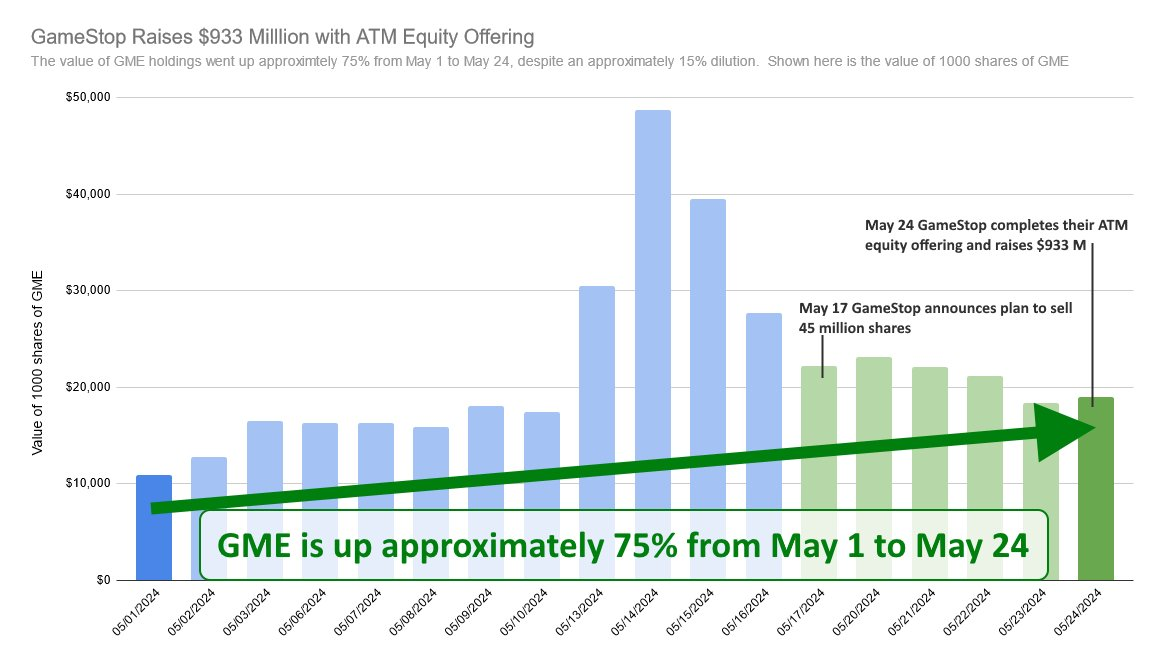

On May 17 GameStop announced plans to sell up to 45 million shares, and on May 24th they announced that all 45 million shares were sold for $933 million, at an average price of about $20.73. Modifying shares outstanding from 306 million to 351 million is an approximately 15% dilution. A shareholder could have expected the value of their own share holdings to have dropped 15% from this action, but shareholder value hardly went down at all as a consequence of the dilution and in fact is up about 75% from May 1 to May 24.

jersan

4 months ago

•

100%

jersan

4 months ago

•

100%

?

source: [gmetimeline.org/ownership](https://gmetimeline.org/ownership)

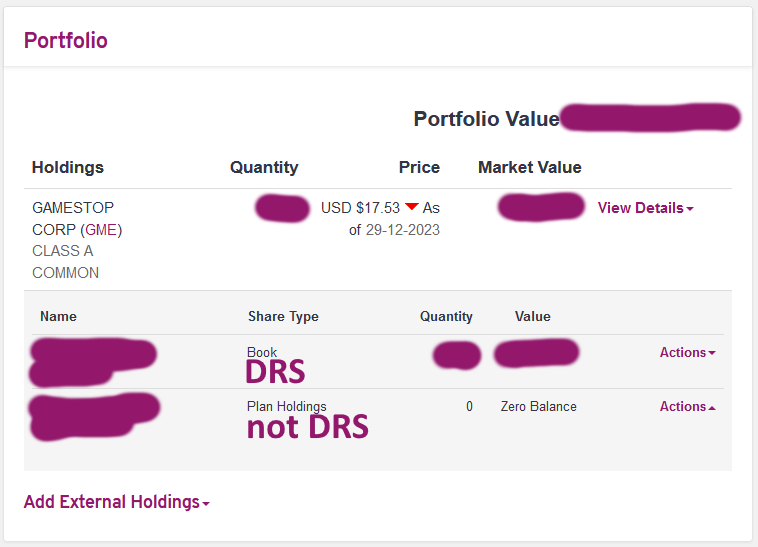

[ image source](https://gmetimeline.org/ownership) # "Held at" DTC versus Computershare As of [March 20, 2024](https://investor.gamestop.com/node/20376/html) there were 305,873,200 shares of GameStop's Class A common stock (GME) outstanding. "Of those outstanding shares, approximately 230.6 million were held by Cede & Co on behalf of the Depository Trust & Clearing Corporation (or approximately 75% of our outstanding shares) and approximately 75.3 million shares of our Class A common stock were held by registered holders with our transfer agent (or approximately 25% of our outstanding shares)." - 25% of issued shares of GME are owned by directly registered shareholders - The other 75% is held by Cede & Co on behalf of the DTCC As of[ May 24, 2024](https://investor.gamestop.com/news-releases/news-release-details/gamestop-completes-market-equity-offering-program-1), GameStop completed an at the market equity offering, and sold 45,000,000 shares, increasing the total amount of shares outstanding to approximately 351,000,000. # DRS vs DSPP Information about DRS versus DSPP counts held at Computershare are not reported publicly. This information is available, however, on the GameStop stockholder list which can be viewed in person at GameStop headquarters. The latest data we have was from 2023 when GME shareholders viewed the stockholder list and obtained some data including DRS vs DSPP counts. Source: https://www.drsgme.org/2023-stock-list-viewing The DRS vs DSPP numbers in the graphic have been rounded for simplicity based off the data from that 2023 source. Of shares held by Computershare: 53 million DRS, 22 million DSPP.

jersan

4 months ago

•

100%

jersan

4 months ago

•

100%

| Before ATM | After ATM (May 24) | |

|---|---|---|

| Shares outstanding (approx) | 305,000,000 | 350,000,000 |

| Cash on hand (approx) | $1 billion | $2 billion |

| DRS % of outstanding shares (approx 75 million DRS) | 24.7% | 21.4% |

May 24, 2024 GRAPEVINE, Texas, May 24, 2024 (GLOBE NEWSWIRE) -- GameStop Corp. (NYSE: GME) (“GameStop” or the “Company”) today announced that it has completed its previously disclosed “at-the-market” equity offering program (the “ATM Program”). GameStop disclosed on May 17, 2024 that it filed a prospectus supplement with the U.S Securities and Exchange Commission to offer and sell up to a maximum amount of 45,000,000 shares of its common stock from time to time through the ATM Program. The Company sold the maximum number of shares registered under the ATM Program for aggregate gross proceeds (before commissions and offering expenses) of approximately $933.4 million. GameStop intends to use the net proceeds from the ATM Program for general corporate purposes, which may include acquisitions and investments.

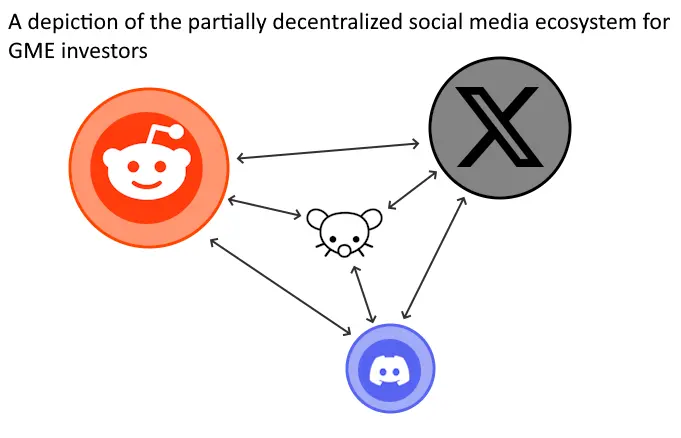

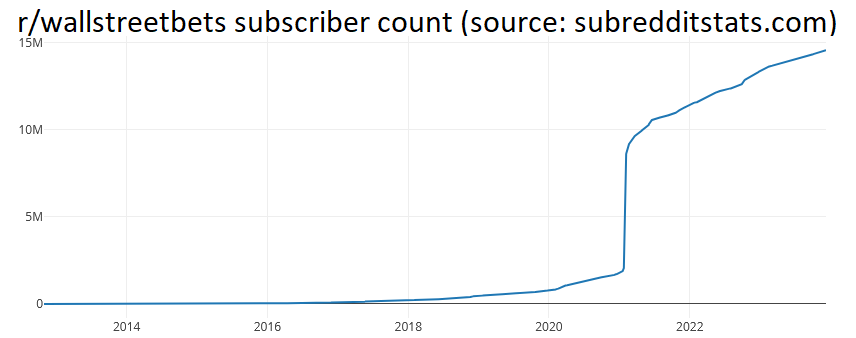

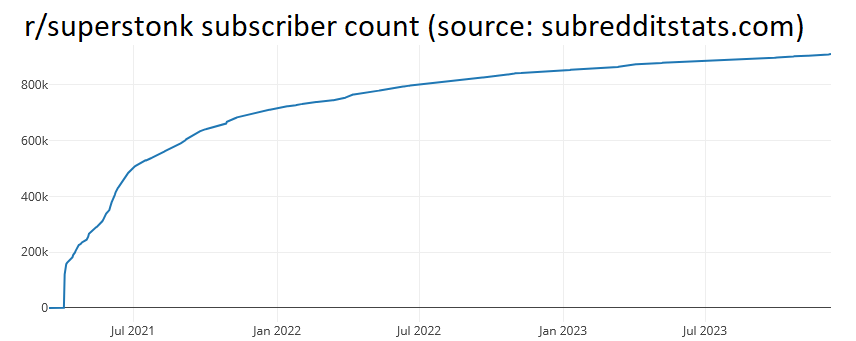

Noticed [this post](https://www.reddit.com/r/Superstonk/comments/1cg9u95/aaaand_we_have_a_other_documentary_about_gamestop/) on reddit, decided to give this >40 minute documentary a watch. - - - - A review of GAMESTOP to the MOON - How Reddit almost triggered an Economic Crisis | FD Finance ★★☆☆☆ 2/5, would not recommend. **TLDR: documentary focuses primarily on the events of late 2020 and early 2021, conflates AMC and GME as equivalent things, concludes with the insinuation that all AMC, GME, and NFT investors are losers that have lost almost everything** ---- - Title of the documentary does not match the content of the documentary. A more appropriate title might have been "the story of Reddit day traders pumping AMC and GME." That is what this documentary was about. - paints most of these investors as either foolish day traders or naive investors, uses words like "gambling", "casino" - lots of FUD sentiment throughout - a few of these investors made a lots of money while most investors were losers - [32:04](https://youtu.be/QS8bMkeRdwo?t=1924) "GameStop led the way. And, as a group, the totality of the group picked AMC next. And, it wasn't like somebody said oh man we're all gonna go over to AMC, it's just kind of you know, that's where the flow goes, that's where the chatter goes, and AMC was the next stock." - for some reason, out of nowhere, in the final 5 minutes the documentary suddenly starts talking about NFTs and makes them out to be pointless. Doesn't mention GameStop's relationship with NFTs but in stead focuses on how NFTs were a speculative bubble with foolish investors, just like with AMC and GME. - - - - Total waste of time. I don't know who the intended audience was for this, but this is just more pointless narrating about the lives of people that experienced events that happened 3 years ago, concluding that the story is over and all those people that didn't get out with gains are losers that are never going to win. It's as if the media like this is stuck in the year 2021. Reddit. Wallstreetbets. AMC. GameStop. Day traders. Robinhood. Down 90% since peak. The end.

jersan

5 months ago

•

100%

jersan

5 months ago

•

100%

never left, not leaving. will be buying more shares and putting them in my name

thanks for your concern though

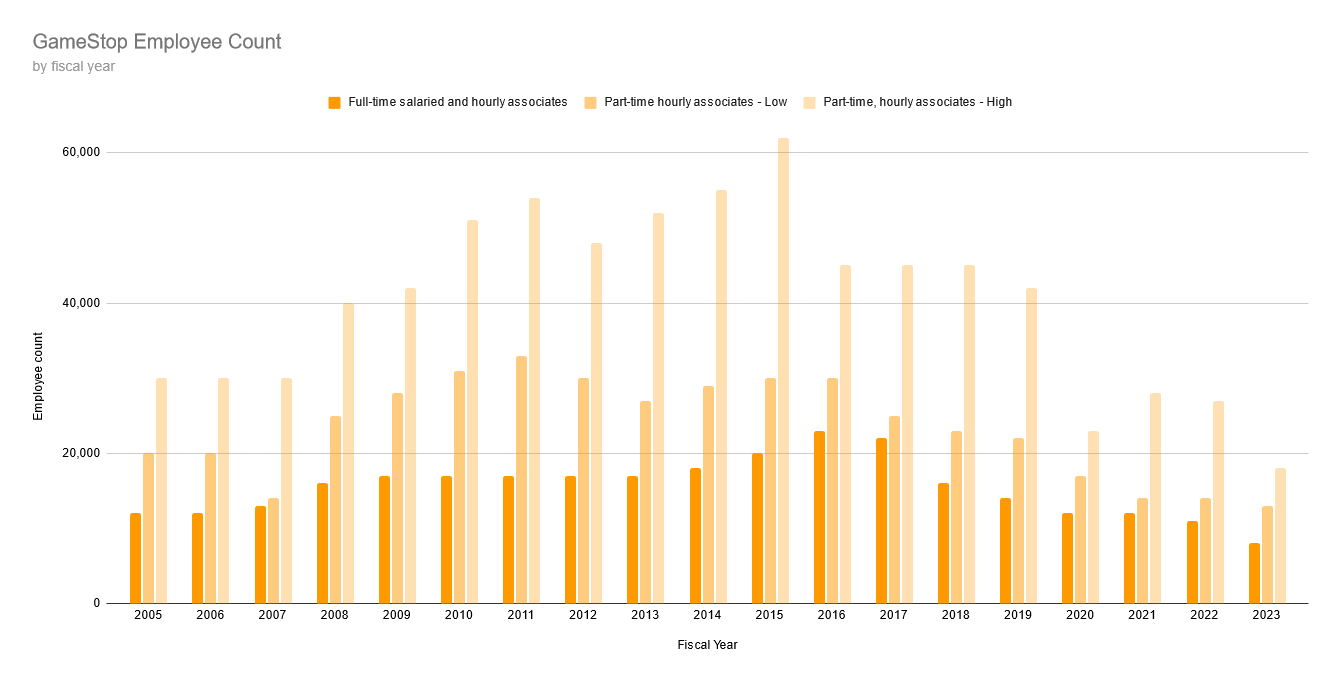

- - - -  - - - -  - - - - data source: [GameStop 10-K filings - Google Sheets document](https://docs.google.com/spreadsheets/d/1kKTpWC96HO3jfOdoLl_eUxivg6rzD-axJ_il2mOyRfk/edit?usp=sharing)

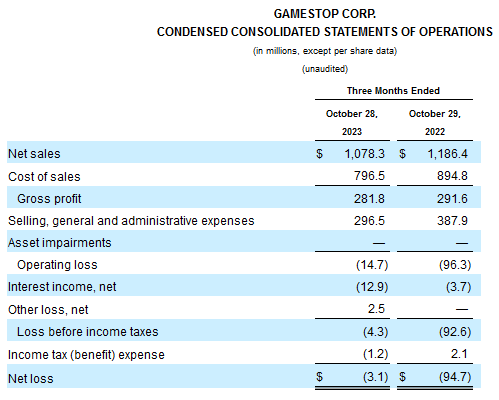

Here is another representation of GameStop's FY23 income statement, this time showing clearly that GameStop had an operating loss of $34.5 M ( compared with an operating loss of $311 M FY22 !) If not for the $49.5 M from interest income, GameStop would not have had positive net earnings in FY23.

Operating loss of $35 M (compared with operating loss of $312 M in FY22) Small but notable net earnings of $6.7 M (compared with net loss of $313 M in FY22) How did GameStop make $50 million in interest income?

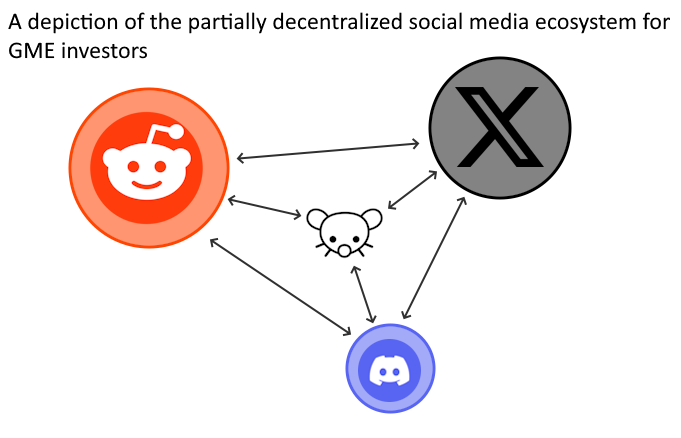

# GameStop was profitable for the first time in 6 years GameStop reported full-year profitability for fiscal year 2023, contradicting the prevailing media sentiment that GameStop is a terrible company destined for bankruptcy - - - - ### Summary - On March 26, 2024, GameStop released financial results for the fourth quarter and fiscal year ended February 3, 2024, demonstrating small but not insignificant full-year profits for the first time in 6 years, despite reduced revenues. "Net income was $6.7 million for fiscal year 2023, compared to a net loss of $313.1 million for fiscal year 2022." - Sentiment of GameStop found in financial media continues to be negative, dishonest, and cynical, despite the undeniable but often ignored improvements to the fundamentals of the company that have been achieved by the new management team. In most cases, the fact that GameStop was profitable for the first time in 6 years is not even mentioned at all. - - - - ### Historical context From a historical point of view, GameStop was consistently profitable every fiscal year from 2005 through 2016, with the exception of 2012. Starting in fiscal year 2017, GameStop began showing reduced profitability, and from FY 2018 through FY 2022, was unprofitable.  Source: [GameStop 10-K filings - Google Sheets ](https://docs.google.com/spreadsheets/d/1kKTpWC96HO3jfOdoLl_eUxivg6rzD-axJ_il2mOyRfk/edit?usp=sharing) Looking exclusively at revenue, it is clear that there has been a significant reduction starting approximately with fiscal year 2019. Much of this can be attributed to the fact that gamers are increasingly buying games digitally rather than in the form of physical discs such as can be purchased at a brick-and-mortar retail store like GameStop. Yet, even in fiscal years 2017 and 2018, it is clear that despite high revenues the company was not performing well. Heading through 2020, GameStop was undeniably a struggling company facing significant challenges, and according to many was destined for bankruptcy. The trading price of GME reflected this prevailing sentiment, and the financial media was dutifully critical. - - - - ### Company turnaround In 2020, activist investor Ryan Cohen began purchasing shares of GME, ultimately becoming the largest individual owner of the company with approximately 12% ownership. By June 2021, the entire board of directors of the company was replaced by Ryan Cohen and his associates, with Ryan Cohen becoming chairman of the board. From this time onward, control of the company was completely in the hands of this new leadership team. >"We inherited a bunch of legacy everything, and under-investment across the entire business –- people, the entire technology stack, just decades of neglect, and so it’s hard to turn around a brick and mortar retailer that’s under the kind of pressure that GameStop was and continues to be under, but that was also part of the attraction going into GameStop was that a transformation the likes of GameStop was really unprecedented and I was motivated by that." - [Ryan Cohen, November 2022](https://gmetimeline.org/rc-interview) The company went from a situation where it was losing hundreds of millions of dollars per year to net profitability in fiscal year 2023. While this is an undeniably positive result for the company in this time period, GameStop continues to face numerous challenges and must continue to improve and adapt in order to successfully compete in the modern video game industry. - - - - ### Media sentiment What does mainstream financial media have to say about GameStop achieving full-year profitability for the first time in 6 years? - [GameStop faces 'unsustainable' sales decline, cuts jobs to control costs](https://www.reuters.com/technology/gamestop-q4-revenue-falls-2024-03-26/) - Focuses on job cuts, reduced revenue, leans on the opinion of Michael Pachter - Fails to mention GameStop achieving full-year profitability - [GameStop Q4 Earnings Highlights: Retail Favorite Stock Plunges After Revenue, EPS Miss](https://www.benzinga.com/news/earnings/24/03/37946470/gamestop-q4-earnings-highlights-retail-favorite-stock-plunges-after-revenue-eps-miss) - Emphasis on GME share price going down - Focuses on reduced revenue - Did mention some favorable facts - Fails to mention GameStop achieving full-year profitability - [GameStop Stock Plummets Following Q4: Profitability Fails to Offset Significant Revenue Miss](https://www.thestreet.com/memestocks/gme/gamestop-stock-plummets-following-q4-profitability-fails-to-offset-significant-revenue-miss) - Headline emphasizes GME share price is down - Makes clear that GameStop achieved full-year profitability for the first time in years - Generally fair reporting of other facts - [GameStop Stock Plunges After Earnings Fall Short of Expectations—Key Level to Watch](https://www.investopedia.com/gamestop-stock-plunges-after-earnings-fall-short-of-expectations-8620855) - Headline emphasizes GME share price is down, 'expectations' were missed - Focus on job cuts, reduced revenue - Fails to mention GameStop achieving full-year profitability - [Jim Cramer Says GameStop Is Arguably The Worst Company In America](https://www.benzinga.com/news/earnings/24/03/37967321/jim-cramer-says-gamestop-is-arguably-the-worst-company-in-america) - Article is entirely negative, leans on the opinions of Jim Cramer and Michael Pachter - Fails to mention GameStop achieving full-year profitability - [GameStop Q4 Earnings Smash Wall Street Expectations: Reports Profitability For First Time In Over Half A Decade](https://www.benzinga.com/news/24/03/37971998/gamestop-q4-earnings-smash-wall-street-expectations-reports-profitability-for-first-time-in-over-hal) - Makes clear and emphasizes contextual significance of GameStop's full-year profitability - Generally positive about GameStop's financial circumstances - [GameStop could be gone in less than 5 years, says analyst](https://www.fastcompany.com/91070475/gamestop-could-be-gone-in-less-than-5-years-says-analyst) - Article is almost entirely negative, leans on the opinions of Michael Pachter - Does mention GameStop's positive cash holdings of $1.2 billion - Claims that Reddit's WallStreetBets has 'seemingly walked away from the “stonk”', fails to mention that GME discussion is censored on WallStreetBets (formally banned by the moderators in 2022), fails to mention that GME shareholders are found in different online communities - Fails to mention GameStop achieving full-year profitability - [GameStop Needs To Get Its Game Back](https://www.benzinga.com/24/03/37962205/gamestop-needs-to-get-its-game-back) - Focuses on reduced revenue, job cuts - Weak mention of GameStop posting a full-year profit of $6.7 million - Generally fair assessment of the struggles faced by GameStop - [GameStop Confirms More Layoffs, Share Price Tumbles After Sales Slide](https://www.gamespot.com/articles/gamestop-confirms-more-layoffs-share-price-tumbles-after-sales-slide/1100-6522189/) - Headline emphasizes job cuts, GME share price is down - Generally neutral article - Does mention GameStop's full-year profitability - [A Sales Slump Is the Kiss of Death for GameStop Stock](https://investorplace.com/2024/04/a-sales-slump-is-the-kiss-of-death-for-gamestop-stock/) - Entirely negative article, leans on the opinion of Michael Pachter - Fails to mention GameStop achieving full-year profitability - 'If you value your wealth, just stay away from GameStop stock.' - [GameStop saga ends. Winner: capital markets](https://www.reuters.com/breakingviews/gamestop-saga-ends-winner-capital-markets-2024-04-03/) - Entirely negative article, leans on the opinion of Michael Pachter - Focuses on GME share price being down - Fails to mention GameStop achieving full-year profitability - 'In this case, “shorts” were right... The meme army may have lost, but perhaps next time will be clearer-eyed.' - [GameStop Stock: Is This The End of a Saga Or Just Another Chapter?](https://www.thestreet.com/memestocks/gme/gamestop-stock-is-this-the-end-of-a-saga-or-just-another-chapter) - Despite any sentiment implied by the headline, this article provides a mostly neutral assessment of GameStop's circumstances - Mentions GameStop achieving full-year profitability Searching for recent news about GameStop yields mostly negative sentiment that fails to even mention at all that GameStop achieved full-year profitability for the first time in 6 years. Failing to mention this important detail is a deliberate decision that reveals a clear bias in the media. It goes beyond just reporting about true negative facts about GameStop. It demonstrates a deliberate effort, by those culpable writers and media outlets, to propagate a specific sentiment about the company that is not allowed to even mention contextually important true positive facts about the company. GameStop was profitable for the first time in 6 years - this is the news headline that captures the significance of GameStop's recent earnings report. Yet, an unassuming person who consumes mainstream financial media likely would not even learn about this important fact at all. Who would benefit from that? - - - - ### Ongoing financial conflict Why are there competing, mutually exclusive narratives? There are competing narratives because there are competing financial interests. One of the listed news articles, *[GameStop saga ends. Winner: capital markets](https://www.reuters.com/breakingviews/gamestop-saga-ends-winner-capital-markets-2024-04-03/)*, from Reuters, draws some attention to this ongoing conflict while declaring that the conflict is actually over and one side has won and one side has lost. GME shareholders that believe in the company turnaround and leadership, despite the real challenges faced by GameStop, have a vested financial interest in the success of the company, with a desire for the share price of GME to go up, and naturally will promote the narrative that supports this financial interest. In opposition to GME shareholders are all of the financial market participants that have a vested financial interest in the share price of GME going down. An example of such a participant would be any hedge fund that has a net short position on GME. The article refers to this faction as "shorts", recogonizing that such a faction with an interest does exist. Naturally, members of this faction will promote the narrative that supports their financial interest. If the prospect of GameStop's success was not an ongoing threat to one faction of incumbent market participants, then there would be no reason to deliberately omit the fact of GameStop's profitability, to pretend that it isn't something that even happened at all. Recognizing that there is an ongoing financial competition between factions that stand to benefit financially from a particular outcome of the GME share price, which faction benefits when most mainstream financial media articles propagate negative sentiment about GameStop and deliberately ignore the contextually significant fact that GameStop was profitable? It is clear: much of mainstream financial media is actively propagating biased narratives to the benefit of the faction that has a vested financial interest in the share price of GME going down. - - - - An interactive version of this article can be found at [gmetimeline.org/fy23-profitability](https://gmetimeline.org/fy23-profitability)

jersan

6 months ago

•

14%

jersan

6 months ago

•

14%

you could sell directly from computershare into a Wise account

For the first 3 quarters of FY 2023, GameStop has posted a total net loss of $56.4 million. Therefore, in order to achieve full-year profitability, GameStop must achieve greater than $56.4 million in net profit for Q4 2023. This is certainly achievable, though not guaranteed. Something like a $100 million net gain for Q4 is possible, but not necessarily very likely. Therefore, in any case of full-year profitability, at best, the PE ratio for GME will almost certainly be above 100, but will more likely be in the several hundreds, or worse. By comparison, the average PE ratio for S&P500 is around 25. https://www.macrotrends.net/2577/sp-500-pe-ratio-price-to-earnings-chart Some PE ratios of other companies: - Microsoft: 37 - Apple: 26 - Nvidia: 213 - Amazon: 89 - Alphabet: 27 - Meta: 42 - Berkshire Hathaway: 10 TLDR: Full-year profitability will be a momentous achievement, but in almost all cases, GME would have a very high PE ratio. Over the following quarters / years, GameStop will still need to increase profits substantially in order to obtain a good PE ratio.

jersan

6 months ago

•

100%

jersan

6 months ago

•

100%

it may very well be one of the last good opportunities to get some GME for cheap.

Either GameStop achieves full-year profitability, or they don't.

GameStop's opponents (those hedge funds and other participants holding a short position seeking the stock price to go down), and their useful bought and paid for media puppets, are well aware of the situation we are in, probably even more aware than most GME shareholders.

Full-year profitability is the target. It's the thing that most shareholders and opponents have their mind on, in terms of material things that matter that could change the narrative, change the dynamic, and ultimately lead towards true price discovery.

If GameStop fails to achieve full year profitability, (e.g. net quarterly earnings for 2023 Q4 to be any amount less than positive ~ $57 million), then this will give the opponents an opportunity to pile on negative sentiment and hit the price down. "After 3 years in control of the company, Ryan Cohen and team fail to achieve widely-expected profitability, stock price down XX %". As a shareholder I obviously hope that this is not the outcome, but I'll be happy with any general improvements to the company's financial standing.

but I think that this is a very achievable target. Net positive $57 million for 2023 Q4 will give full-year profitability for FY 2023. Any number above that is a major success, and completely feasible. Not guaranteed by any means, but realistically achievable.

And if this is achieved, then it shoots a giant hole in the persistent negative media narrative that has been put upon GameStop these past few years by dishonest and manipulative wall street incumbents and their dishonest and manipulative friends in the financial media.

in the scenario of full-year profitability, some positives with respect to an investment in GME:

- Full-year profitability. This would be the first year in 6 years that GameStop would achieve this profitability. The last time was in FY 2017. Undeniable evidence of successful turnaround efforts.

- cash in the bank to the tune of around $1 billion, unless significant amounts are spent on something such as an investment or a merger/acquisition, which would itself likely be positive news.

- no debt* (except perhaps the negligible French loan. it would be nice to be able to say no debt, definitively, without an asterisk. will this loan still be outstanding in any amount?).

- The video gaming industry is a $200 billion per year industry, and growing, larger than movies, music, and books combined.

- GameStop continues to make improvements to their business including for example in e-commerce, internal processes, new ventures

Obviously, not everything is sunshine and rainbows. GameStop still faces headwinds and has many competitors. In the long term, GameStop also needs to dramatically grow top-line revenue if it ever wants to become the giant that many shareholders believe it to be. These are not small accomplishments.

In the short term, in the face of the achievement of full-year profitability, and all the other positives that GameStop has going for it, how can the media sentiment towards GameStop continue to be so negative and cynical? Surely they will try, but it will become increasingly untenable to try and spin negativity about a situation that is very obviously positive. The negative media narrative is there to try and prevent additional investors from ever considering GME as a valid investment. But at some point the truth of the fundamentals become more powerful than the lies of the media. All it will take is some significant buying pressure and the price could break out.

Who knows what will happen.

I hope GameStop reports $57 million or more in net earnings for Q4 2023. We'll find out in less than 2 weeks.

jersan

7 months ago

•

100%

jersan

7 months ago

•

100%

i disagree with the assertion that heat lamp has been debunked, though it seems like some people really want people to necessarily believe this to be true and final.

put aside the name "heatlamp theory" and address 2 of the main points:

-

- Plan is not DRS. "Plan is not DRS" is not debunked, just because GameStop rejected the shareholder proposals, or that there were issues with the shareholder proposals. The simple fact remains, that plan shares are not DRS shares.

-

- On some DRS record dates, there have been large spikes in volume. Heat lamp offers a possible explanation for how / why. It is a theory, and it isn't necessarily totally right. But, if not right, then how else are these volume spikes explained? To my knowledge, nobody else has put together a thoughtful explanation as to why volume of GME traded spikes on some but not all DRS record dates.

Okay, so heat lamp as originally proposed might not be the fully accurate explanation for the volume spikes. So what are the alternative explanations then?

Something worth noting is that there seems to be a very effortful push to authoritatively declare "DEBUNKED!" without explaining specifically how it is debunked, and without providing any alternative explanations.

- Observation: GME volume spikes on some DRS record dates.

- Theory: "i propose that the reason why this happens is because..."

- Opposition: "Heatlamp is definitively debunked and there is no other explanation!"

Plan is not DRS is a true statement and is not debunked.

GME has unusual trading volume on some DRS record dates, this is another true observation that is not debunked.

One theory that attempts to tie these things together might not be completely accurate but to my awareness is the most thoughtful explanation that exists thus far. I'd love to see alternative explanations but I don't know of any. Superstonk mods by consensus are opposed to the notion that there is any validity to heatlamp theory, yet offer absolutely nothing else as an alternative.

TLDR: "heatlamp is debunked" is just another example of narrative control being perpetrated by a group of moderators of the largest GME internet community. More information is needed to make any kinds of authoritative claims.

jersan

7 months ago

•

100%

jersan

7 months ago

•

100%

exciting!

with respect to GME, filing date for Q4 is usually mid March

| Quarter | Filing Date | Document Date |

|---|---|---|

| Q4 2022 | March 21, 2023 | January 28, 2023 |

| Q4 2021 | March 17, 2022 | January 29, 2022 |

| Q4 2020 | March 23, 2021 | January 30, 2021 |

| Q4 2019 | March 26, 2020 | February 1, 2020 |

| Q4 2018 | April 2, 2019 | February 2, 2019 |

jersan

7 months ago

•

100%

jersan

7 months ago

•

100%

Updated image, original image was missing Technology Brands stores for FY 2013.

Breakdown of GameStop stores by Technology Brands stores versus Video Game Brands stores versus all International stores [Google Sheets Link](https://docs.google.com/spreadsheets/d/e/2PACX-1vT7n4mmCwtjREaCkJVUkHe_ujHBod7vGtEB5iI_kbYToT5dU9cQSq-d3XO2PuFEZ64GCuU70jVayE0R/pubchart?oid=2015565720&format=interactive)

And for fun, GameStop Net Income Per Store  - - - - | Fiscal Year | Revenue | Net Income | Store Count | Revenue Per Store | Net Income Per Store | 10-K | |-------------|----------------|---------------|-------------|-------------------|----------------------|------| | 2005 | $3,091,783,000 | $100,784,000 | 4490 | $688,593.10 | $22,446.33 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000095013406006576/d34677e10vk.htm)| | 2006 | $5,318,900,000 | $158,250,000 | 4778 | $1,113,206.36 | $33,120.55 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000095013407007555/d45113e10vk.htm)| | 2007 | $7,093,962,000 | $288,291,000 | 5264 | $1,347,637.16 | $54,766.53 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000095013408005892/d55358e10vk.htm)| | 2008 | $8,805,897,000 | $398,282,000 | 6207 | $1,418,704.20 | $64,166.59 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000095013409006730/d66430e10vk.htm)| | 2009 | $9,077,997,000 | $377,265,000 | 6450 | $1,407,441.40 | $58,490.70 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000095012310030164/d70778e10vk.htm)| | 2010 | $9,473,700,000 | $408,000,000 | 6670 | $1,420,344.83 | $61,169.42 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000095012311030842/d80233e10vk.htm)| | 2011 | $9,550,500,000 | $339,900,000 | 6683 | $1,429,073.77 | $50,860.39 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000119312512134615/d283661d10k.htm)| | 2012 | $8,886,700,000 | -$269,700,000 | 6602 | $1,346,061.80 | $40,851.26 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000119312513140443/d469015d10k.htm)| | 2013 | $9,039,500,000 | $354,200,000 | 6675 | $1,354,232.21 | $53,063.67 | [link ](https://gamestop.gcs-web.com/static-files/3eb3d63d-81ac-484b-a131-ed7ab2d0ecaa)| | 2014 | $9,296,000,000 | $393,100,000 | 6690 | $1,389,536.62 | $58,759.34 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638015000078/form10k-fy14.htm)| | 2015 | $9,363,800,000 | $402,800,000 | 7117 | $1,315,694.82 | $56,596.88 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638016000323/a10ka-fy15q4.htm)| | 2016 | $8,607,900,000 | $353,200,000 | 7535 | $1,142,388.85 | $46,874.59 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638017000046/a10k-fy16q4.htm)| | 2017 | $9,224,600,000 | $34,700,000 | 7276 | $1,267,811.98 | $4,769.10 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638018000033/a10k-fy17q4.htm)| | 2018 | $8,285,300,000 | -$673,000,000 | 5830 | $1,421,149.23 | $115,437.39 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638019000052/a10k-fy18q4.htm)| | 2019 | $6,466,000,000 | -$470,900,000 | 5509 | $1,173,715.74 | $85,478.31 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638020000022/a10k-fy19q4.htm)| | 2020 | $5,089,800,000 | -$215,300,000 | 4816 | $1,056,852.16 | $44,705.15 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638021000032/gme-20210130.htm)| | 2021 | $6,010,700,000 | -$381,300,000 | 4573 | $1,314,388.80 | $83,380.71 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638022000021/gme-20220129.htm)| | 2022 | $5,927,200,000 | -$313,100,000 | 4413 | $1,343,122.59 | $70,949.47 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638023000019/gme-20230128.htm)|

jersan

7 months ago

•

100%

jersan

7 months ago

•

100%

The link is in the post, they are all on that page, but here:

As a reminder, shareholder proposals are submitted by real people with real names. As a matter of courtesy it would be appropriate to respect the privacy of these individuals as much as possible.

And to my awareness, it does not matter which country a shareholder resides in, the qualifications to submit a proposal are only that a shareholder has held a minimum dollar value of shares for a minimum amount of time, as specified here:

- ≥$2,000 for at least 3 years, OR

- ≥$15,000 for at least 2 years, OR

- ≥$25,000 for at least 1 year

| Fiscal Year | Revenue | Net Income | Store Count | Revenue Per Store | Net Income Per Store | 10-K | |-------------|----------------|---------------|-------------|-------------------|----------------------|------| | 2005 | $3,091,783,000 | $100,784,000 | 4490 | $688,593.10 | $22,446.33 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000095013406006576/d34677e10vk.htm)| | 2006 | $5,318,900,000 | $158,250,000 | 4778 | $1,113,206.36 | $33,120.55 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000095013407007555/d45113e10vk.htm)| | 2007 | $7,093,962,000 | $288,291,000 | 5264 | $1,347,637.16 | $54,766.53 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000095013408005892/d55358e10vk.htm)| | 2008 | $8,805,897,000 | $398,282,000 | 6207 | $1,418,704.20 | $64,166.59 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000095013409006730/d66430e10vk.htm)| | 2009 | $9,077,997,000 | $377,265,000 | 6450 | $1,407,441.40 | $58,490.70 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000095012310030164/d70778e10vk.htm)| | 2010 | $9,473,700,000 | $408,000,000 | 6670 | $1,420,344.83 | $61,169.42 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000095012311030842/d80233e10vk.htm)| | 2011 | $9,550,500,000 | $339,900,000 | 6683 | $1,429,073.77 | $50,860.39 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000119312512134615/d283661d10k.htm)| | 2012 | $8,886,700,000 | -$269,700,000 | 6602 | $1,346,061.80 | $40,851.26 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000119312513140443/d469015d10k.htm)| | 2013 | $9,039,500,000 | $354,200,000 | 6675 | $1,354,232.21 | $53,063.67 | [link ](https://gamestop.gcs-web.com/static-files/3eb3d63d-81ac-484b-a131-ed7ab2d0ecaa)| | 2014 | $9,296,000,000 | $393,100,000 | 6690 | $1,389,536.62 | $58,759.34 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638015000078/form10k-fy14.htm)| | 2015 | $9,363,800,000 | $402,800,000 | 7117 | $1,315,694.82 | $56,596.88 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638016000323/a10ka-fy15q4.htm)| | 2016 | $8,607,900,000 | $353,200,000 | 7535 | $1,142,388.85 | $46,874.59 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638017000046/a10k-fy16q4.htm)| | 2017 | $9,224,600,000 | $34,700,000 | 7276 | $1,267,811.98 | $4,769.10 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638018000033/a10k-fy17q4.htm)| | 2018 | $8,285,300,000 | -$673,000,000 | 5830 | $1,421,149.23 | $115,437.39 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638019000052/a10k-fy18q4.htm)| | 2019 | $6,466,000,000 | -$470,900,000 | 5509 | $1,173,715.74 | $85,478.31 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638020000022/a10k-fy19q4.htm)| | 2020 | $5,089,800,000 | -$215,300,000 | 4816 | $1,056,852.16 | $44,705.15 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638021000032/gme-20210130.htm)| | 2021 | $6,010,700,000 | -$381,300,000 | 4573 | $1,314,388.80 | $83,380.71 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638022000021/gme-20220129.htm)| | 2022 | $5,927,200,000 | -$313,100,000 | 4413 | $1,343,122.59 | $70,949.47 | [link ](https://www.sec.gov/Archives/edgar/data/1326380/000132638023000019/gme-20230128.htm)|

As many are aware, the SEC recently published Incoming [No-Action Requests Under Exchange Act Rule 14a-8](https://www.sec.gov/corpfin/shareholder-proposals-incoming?), and there were several shareholder proposals submitted by GME shareholders that were rejected by the company that were published there. There have already been a few discussions of these proposals on Reddit and on X and on Discord at least. Some of the discussions about the rejected proposals have been nothing but negative and cynical and even disparaging towards those shareholders that submitted proposals. So I just wanted to make this post to express some gratitude towards those shareholders that submitted a proposal, despite that GameStop rejected them. It's really easy to criticize. It's very easy to sit behind a keyboard and put other people down while otherwise contributing nothing. It takes almost no effort to do this. It's hard to build things, it's much easier to destroy things. Those shareholders that submitted proposals are the types of people that are builders. They are activists. They are building and advancing our collective knowledge. Some other people are not builders. They are destroyers. They revel when the builders struggle. They celebrate when the builders face setbacks. They scorn and shame the builders for having tried at all. I sincerely appreciate the efforts of any shareholder that took the time and energy to submit a proposal, any proposal at all, even if it gets rejected. Every little thing that GME shareholders do that produces additional knowledge is beneficial overall to all shareholders. Some parties out there in the world that are in opposition to GME shareholders don't like this. They don't like it when GME shareholders get loud and get active. They would much prefer it if we would all just shut up and go away and forget GameStop. That's not going to happen. I for one am not going anywhere. 🍻

jersan

8 months ago

•

100%

jersan

8 months ago

•

100%

some more data going back to fiscal year 2005.

| Fiscal Year | Revenue | Net Income | Store Count | Revenue Per Store | Net Income Per Store | 10-K |

|---|---|---|---|---|---|---|

| 2005 | $3,091,783,000 | $100,784,000 | 4490 | $688,593.10 | $22,446.33 | link |

| 2006 | $5,318,900,000 | $158,250,000 | 4778 | $1,113,206.36 | $33,120.55 | link |

| 2007 | $7,093,962,000 | $288,291,000 | 5264 | $1,347,637.16 | $54,766.53 | link |

| 2008 | $8,805,897,000 | $398,282,000 | 6207 | $1,418,704.20 | $64,166.59 | link |

| 2009 | $9,077,997,000 | $377,265,000 | 6450 | $1,407,441.40 | $58,490.70 | link |

| 2010 | $9,473,700,000 | $408,000,000 | 6670 | $1,420,344.83 | $61,169.42 | link |

| 2011 | $9,550,500,000 | $339,900,000 | 6683 | $1,429,073.77 | $50,860.39 | link |

| 2012 | $8,886,700,000 | -$269,700,000 | 6602 | $1,346,061.80 | $40,851.26 | link |

| 2013 | $9,039,500,000 | $354,200,000 | 6675 | $1,354,232.21 | $53,063.67 | link |

| 2014 | $9,296,000,000 | $393,100,000 | 6690 | $1,389,536.62 | $58,759.34 | link |

| 2015 | $9,363,800,000 | $402,800,000 | 7117 | $1,315,694.82 | $56,596.88 | link |

| 2016 | $8,607,900,000 | $353,200,000 | 7535 | $1,142,388.85 | $46,874.59 | link |

| 2017 | $9,224,600,000 | $34,700,000 | 7276 | $1,267,811.98 | $4,769.10 | link |

| 2018 | $8,285,300,000 | -$673,000,000 | 5830 | $1,421,149.23 | $115,437.39 | link |

| 2019 | $6,466,000,000 | -$470,900,000 | 5509 | $1,173,715.74 | $85,478.31 | link |

| 2020 | $5,089,800,000 | -$215,300,000 | 4816 | $1,056,852.16 | $44,705.15 | link |

| 2021 | $6,010,700,000 | -$381,300,000 | 4573 | $1,314,388.80 | $83,380.71 | link |

| 2022 | $5,927,200,000 | -$313,100,000 | 4413 | $1,343,122.59 | $70,949.47 | link |

jersan

8 months ago

•

0%

jersan

8 months ago

•

0%

jersan

8 months ago

•

100%

jersan

8 months ago

•

100%

jersan

8 months ago

•

100%

jersan

8 months ago

•

100%

nice post OP! love your original art.

it often takes me a while to figure out what it says when looking at the static images. this one took me a solid 2 minutes.

TERMINATE DSPP!

jersan

8 months ago

•

100%

jersan

8 months ago

•

100%

Another example, January 29, 2024.

Why do they do this shit? What possible benefit do the moderators of superstonk get by posting this? Why are they trying so hard to stay in control of the narrative? Why do they act as if they are an authority on this topic?

The last time GameStop posted positive full-year earnings was in 2017. There has been a fair amount of talk of GameStop posting full-year profitability for the 2023 fiscal year, which is definitely within reach, but not guaranteed. If GameStop posts full year earnings for FY23, it will be the first time in 6 years. It will be a momentous occasion! It will also demonstrate that the prevailing sentiment put out by mainstream media doesn't reconcile with the reality that this company is not the loser that they want the world to think it is.

jersan

8 months ago

•

100%

jersan

8 months ago

•

100%

sorry, correction, not ALL of the information in the chart was exclusively from that section of the 10-Q, there was also this section of the revenue:

#### December 6, 2023: GameStop reports 2023 Q3 quarterly results - [Earnings Release](https://gamestop.gcs-web.com/news-releases/news-release-details/gamestop-discloses-third-quarter-2023-results) - [10-Q](https://gamestop.gcs-web.com/sec-filings/sec-filing/10-q/0001326380-23-000063) - - - - ### Net loss of $3.1 million for the quarter - - - - All of the information in this diagram is derived from this section of the 10-Q:  - - - - [Earnings discussion thread (December 6, 2023)](https://lemmy.whynotdrs.org/post/480013)

jersan

8 months ago

•

100%

jersan

8 months ago

•

100%

all in all it was a decent movie.

"but it doesn't talk about [insert thing here] so therefore it was not good!"

i disagree with that notion. no such thing as bad press, and all that, and this movie isn't even bad press. it was fun and entertaining, which is typically the purpose of most movies. it was not a fact-based documentary, it's hollywood entertainment that is shining a light on an important story.

i do find it funny how much hate the movie is getting in superstonk.

In any kind of situation, sorry if I sound like a broken record here, but I always ask myself: who benefits?

We know that Public Relations is something that exists as an industry and as a component of businesses. Businesses use PR in order to shape public perception, away from something negative and sensitive to the business and towards something positive and helpful for the business.

E.g.: what did tobacco / cigarette companies do when research started coming out demonstrating that cigarettes caused cancer? Were those companies honest and forthright, and admit to this true reality even though admitting it would hurt their sales? Or did they do everything in their ability to obfuscate the truth and confuse people, because those actions led to an outcome of continued profits for the company?

We know that wall street and other industries make use of shill farms. Shill farms are basically the modern evolution of PR. If you are a wealthy and powerful incumbent and you are not using shill farms, you will fall behind and lose control of the narrative.

so, in a contest of "promote Dumb Money because it brings positive attention to GameStop", versus "Dumb Money sucks and was bad and was not good and I hated it and it didn't properly represent the story", which one of these thought processes is helpful to GME investors and which one is not?

And in consideration of that, why is it that superstonk is so loaded with antagonism towards this movie?

jersan

8 months ago

•

100%

jersan

8 months ago

•

100%

I think you might be right, though it is impossible to know for sure.

Like how the price started pumping a few days prior to December 6 earnings because those earnings were going to be decent and cause a positive reaction. So they get ahead of the positive reaction by preemptively pumping it beforehand for the purpose of preventing or slowing any momentum. This is what i suspect happened and may happen again in March of this year prior to earnings date.

jersan

8 months ago

•

100%

jersan

8 months ago

•

100%

Another kind of example of the censorship and confusion on this topic that continues to happen to this very day. It is for this reason why the subject needs to be repeatedly discussed and understood by as many GME shareholders as possible, because to this very day they continue to censor and confuse this topic to varying degrees.

January 23, 2024: a post that provides good information about the distinction between DRS and DSPP numbers gets removed from superstonk.

Even if well intentioned, posts like these ultimately are encouraging selling of shares, turning off autobuys, and sowing distrust in ComputerShare. The sources provided don’t back up these claims and how one person is interpreting this does not mean it’s fact. Please do your own due diligence when it comes to making decisions for your investment. Rule 6.

Why is this topic so contentious? Why has there been a sustained campaign to censor and confuse this specific topic, the topic of the distinction of DSPP and DRS, the fact that plan is not DRS?

Who benefits if it is crystal clear and all GME investors understand the truth? GME investors benefit. Who benefits if it is confusing and controversial and omitted (censored) from conversation? Not GME investors.

jersan

8 months ago

•

100%

jersan

8 months ago

•

100%

Great post. Insightful but not surprising.

From the perspective of a money-seeking billionaire like this, everything in the world is only as valuable as its measurement in dollars. Really, this type of behavior is completely normal and maybe even "smart", from the perspective of a capitalist system that rewards greed above all else.

If I am not mistaken, I also read that both Meta and Google, during the big hiring spree of 2021 / 2022, deliberately over-hired thousands of employees with no real work for them, just so that the competitors couldn't get those employees.

Imagine having so much excessive money that you can pay thousands of employees just to do nothing, simply so that your competitors might not get them.

Corporate behavior in modern capitalism is pretty fucked up. It's great if you are one of the few ultra wealthy individuals and all you care about is making more money than you even know what to do with. But beyond them, it's a ruthless and unfair system that will spit you out without a second thought, if it means some rich bastard can make even more money.

jersan

8 months ago

•

100%

jersan

8 months ago

•

100%

I agree!

I did start such a list but it is by no means comprehensive. Someone can take that info and expand on it :)

TLDR: - CNBC is financial propaganda designed to further the interests of its owners. - [CNBC is owned by Comcast, which is 88% owned by institutions (Wall Street)](https://lemmy.whynotdrs.org/post/408629) - The owners of CNBC is Wall Street, and [what Wall Street wants is more money and power for themselves and less for everybody else](https://lemmy.whynotdrs.org/post/365982). - When a person watches CNBC, they are consuming information designed to take money out of their pocket and put it into Wall Street's pocket. - #### The purpose of CNBC (and other financial propaganda outlets) is to help Wall Street get more money and power for themselves and less for everybody else. - - - - I recently saw [this post](https://lemmy.whynotdrs.org/post/641291) and it made me curious to see how Upstart has fared since that CNBC interview was originally aired. the original video clip appears to be [from an October 15, 2021 CNBC interview with a guest by the name of Mark Minervini.](https://www.cnbc.com/video/2021/10/15/divergence-between-stocks-inside-the-stock-markets-minervini-says.html) If you go to that CNBC link to view the clip, you will not find the part where Mark Minervini reveals that he has no idea what Upstart Holdings even does, this part has been conveniently removed. [Wikipedia says](https://en.wikipedia.org/wiki/Upstart_Holdings): "Upstart is an AI lending platform that partners with banks and credit unions to provide consumer loans using non-traditional variables, such as education and employment, to predict creditworthiness. " By matter of pure coincidence, October 15, 2021, the same day that the original CNBC interview aired, was also the same day that Upstart Holdings was at an all time high market valuation.  So, recap: - in late 2020, some company that nobody has ever heard of called Upstart Holdings, ticker UPST, that performs some vague "AI lending platform", does an IPO - UPST rises from IPO all the way until October 2021. - October 15, 2021, wall street finance propaganda channel CNBC gets some stooge to sit in front of a camera and shill for some ticker that he doesn't even know what it is. "Upstart is up about 25 percent just in four days, that's a good looking name. Very powerful, very strong earnings, " this is the type of great due diligence that CNBC has to offer here. It's a great stock because it's up and up is good. Put your money in now, because stock goes up. - (the movie The Big Short draws attention to this [concept of "Hot Hands"](https://www.youtube.com/watch?v=Pxr_FzpPM2Q) that is a bias that people have: "people think whatever is happening now is going to continue to happen into the future") - October 15, 2021, to present: UPST is down more than 90% since CNBC was pumping it. - - - - #### Who owns CNBC? [CNBC is owned by Comcast, which is 88% owned by institutions (Wall Street)](https://lemmy.whynotdrs.org/post/408629) #### What is CNBC's purpose? The purpose of CNBC is the same purpose any propaganda machine. Wikipedia provides this handy definition of [propaganda](https://en.wikipedia.org/wiki/Propaganda), emphasis mine: > Propaganda is communication that is primarily used to **influence or persuade an audience** to further an agenda, which may not be objective and may be selectively presenting facts to **encourage a particular synthesis or perception**, or using **loaded language** to produce an **emotional rather than a rational response** to the information that is being presented. Propaganda can be found in a wide variety of different contexts. Propaganda is the art of manipulating the perception of the target audience using a variety of lies, deceptions, and omissions of information. It has been famously said that **all warfare is based on deception.** For example in the context of a war, propaganda can be used to motivate your own troops by selling a perception of strength and success, and it can be used to demoralize your opponent's troops by selling a perception of weakness and defeat. In war, propaganda is simply a tool used to help the war-interests of the party that is utilizing the propaganda. It's the same in the world of finance. Financial propaganda is designed to manipulate perceptions so that the person or party that is doing the manipulating may somehow benefit. The owner of a propaganda machine like CNBC deploys the art of deception and the outcome is that the audience that consumes it subsequently hands over their hard earned money **willingly** and places it into the possession of that same propaganda owner. The victim is led to believe that the information they consumed was a hot tip that might help them make some more money, but of course it was actually just a trap that took their money and gave it to Wall Street in stead.

jersan

8 months ago

•

100%

jersan

8 months ago

•

100%

oh man. thanks OP for reminding me of this.

I was going to leave a comment here but I am going to make a post about it in stead.

TLDR:

CNBC is financial propaganda designed to further the interests of its owners.

The owners of CNBC is Wall Street, and what Wall Street wants is more money and power for themselves and less for everybody else.

Therefore, CNBC's purpose for existence is to help Wall Street get more money and power for themselves and less for everybody else.

This is a December 2023 updated version of [this chart which was previously posted](https://lemmy.whynotdrs.org/post/425940). - [Original chart by visualcapitalist.com November 2020](https://www.visualcapitalist.com/50-years-gaming-history-revenue-stream/) - [Updated chart by visualcapitalist.com December 2023](https://www.visualcapitalist.com/video-game-industry-revenues-by-platform/) - - - - This is a chart that shows information that is relevant to the interests of GME investors. What is once again glaringly obvious is that mobile is the largest and growing area of video gaming revenue. As it seems that [GameStop is disengaging from web3 related ventures](https://lemmy.whynotdrs.org/post/631846), in order to grow and succeed, GameStop will need to find reliable revenue streams. How could a company like GameStop get a cut of that mobile gaming revenue?

jersan

8 months ago

•

100%

jersan

8 months ago

•

100%

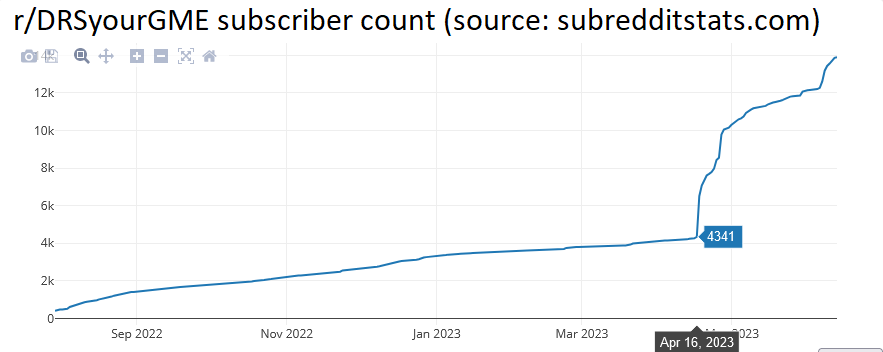

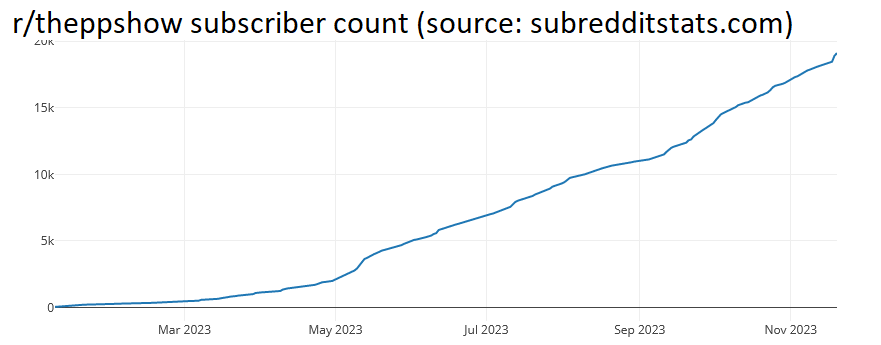

"Don't forget to make sure your dividend reinvestment plan is set up again!"

Why? Why say this?

TLDR: the terms "Book" and "Plan" continue to be deliberately confused, in places of significance, and this is why it's important to continuously reiterate the simple true statement that ### **[ 📢 plan is not DRS](https://lemmy.whynotdrs.org/post/487756)**. - - - - Somebody makes a post in superstonk that makes reference to the distinction that plan is not DRS. In response to this, [superstonk mods reply and pin to the top of that post](https://www.reddit.com/r/Superstonk/comments/196ojws/comment/khv8b4a/?utm_source=share&utm_medium=web2x&context=3) a template message over 600 words in length that would confuse somebody who didn't know better about the plain indisputable reality that **Plan is not DRS**. ["Plan versus Book" is a misnomer](https://lemmy.whynotdrs.org/post/575406) because all electronic shares are book-entry shares. This includes Plan (aka DSPP aka DirectStock) shares and DRS shares. It only takes 4 words to reiterate the correct truth of this distinction, the distinction being that **plan is not DRS**, but for some reason this is something that continues to be deliberately confused to this very day in 2024 by people that have authority over the largest online community of GME investors. The messaging by moderators of the largest GME community has consistently been deliberately confusing and misleading, and will lead to the outcome where uninformed individuals will have an incorrect view about what is DRS and what is not DRS. Who benefits from this? Why do the unelected, unaccountable moderators of the largest online GME community continue to perpetrate a misleading view about something that is now so plainly indisputable? - - - - A brief history of "plan versus book": - November 19, 2022 - Ryan Cohen tweets: ["I also want to be the book king!"](https://twitter.com/ryancohen/status/1593989511171784705) - "Plan versus book" enters the conscious awareness of superstonk, and thousands of people start discussing this. - Superstonk mods, slowly but surely, from Nov 2022 to January 2023, put a damper on these conversations while at the same time injecting their own several-hundred-word-deliberately-confusing message into these threads and pinning that message to the top so that everyone has to see what they want everyone to see, above what the community is talking about. "HEY OP. IT LOOKS LIKE YOU WANT TO TALK ABOUT PLAN AND BOOK. PREPARE YOURSELF FOR 600 WORDS OF PURE CONFUSION" - By January / February of 2023, [threads about "plan versus book" disappear from superstonk](https://lemmy.whynotdrs.org/post/4182). On odd occasion a post about this topic would come up, and get removed with a justification like "this post was removed because we already had to moderate this kind of content before!" - if the objective was to prevent further discussion of the distinction between plan shares and DRS shares, it was successful. - in April 2023, a post is made in a different subreddit, r/DRSyourGME, that re-ignites the discussion about this topic that was successfully silenced up to that point - superstonk mods tried hard to censor this topic and remove any and all mentions of what was being discussed over in r/DRSyourGME. But, their attempts at censorship failed. - uh oh.  the truth is leaking beyond superstonk's walls. Can't have that. [superstonk mods publicly denounce](https://www.reddit.com/r/Superstonk/comments/145j69y/fireside_chat_692023_on_the_topic_of_doxxing_and/?sort=top) the folks from the r/DRSyourGME subreddit and accuse them of acting inappropriately. - Reddit decides to [ban the subreddit](https://lemmy.whynotdrs.org/post/4183). - June 2023 to early December 2023 - "plan versus book" once again disappears from the conscious awareness of the largest GME community. - [December 2023](https://lemmy.whynotdrs.org/post/494562) - in a [live X spaces earnings call for GME Q3 earnings on December 6](https://twitter.com/Badmojo6969/status/1732501802208084073), an important conversation takes place that once again draws attention to the existence of the distinction between DRS and DSPP. It is once again re-iterated that DSPP is not DRS. - December 8: [Why are DRS numbers stagnant? Exploring the possibilities ... Plan is not DRS](https://lemmy.whynotdrs.org/post/487756) - post by Chives - December 9: that post is then [posted to r/GME](https://www.reddit.com/r/GME/comments/18ekym1/crosspost_from_lemmy_why_are_drs_numbers_stagnant/) - Why is this important distinction being talked about by GME investors but not in the biggest GME investor subreddit? - Apparently, the effort to continue censoring is waning. By whichever reasoning, perhaps out of the self-interested understanding that continuing to censor the topic leads to suspicion, superstonk mods relent and so graciously [permit a post about this to exist](https://lemmy.whynotdrs.org/post/544168). - December 22: [Plan is not DRS](https://www.reddit.com/r/Superstonk/comments/18onddp/plan_is_not_drs/) - a post is made by jackofspades123 based on the original post by Chives. - December 22, 2023, to present: After over an entire year of this, the effort to confuse and silence discussions about the distinction between plan and DRS have failed. Censorship is no longer a viable method of information control on this topic. Time to switch gears back towards propagating and pinning a template comment that deliberately confuses the words plan and book, while continuing to ignore the important thing that plan is not DRS. - any new GME investor that is interested in DRS that gets exposed to this misleading information risks having their shares enrolled in a plan, even though what they were really seeking was DRS. - - - - ### Who benefits if people are misled or misinformed about the distinction that plan is not DRS? I don't necessarily know who benefits, but I know for certain that individuals seeking to inform themselves about DRS *do not* benefit when what they actually end up consuming is misinformation.

jersan

8 months ago

•

100%

jersan

8 months ago

•

100%

even this very post by myself, from June 2023, includes phrases like "DRS plan versus DRS book". This is part of the problem. This is an outcome by attempts to deliberately confuse the idea that Plan is a form of DRS but it is not.

Plan is not DRS.

Who benefits if GME investors do not understand that plan is not DRS?

jersan

8 months ago

•

100%

jersan

8 months ago

•

100%

January 2024 update: "Plan versus Book" is a misnomer

January 6, 2022: [GameStop Plans to Launch an NFT Marketplace](https://www.bloomberg.com/news/articles/2022-01-06/gamestop-plans-to-launch-nft-marketplace-in-turnaround-push) ----- February 3, 2022: ### [GameStop Forms Partnership with Immutable X](https://news.gamestop.com/news-releases/news-release-details/gamestop-forms-partnership-immutable-x) The partnership establishes an up to $100 million fund in Immutable X’s IMX tokens, which the parties intend to use for grants to creators of non-fungible token (“NFT”) content and technology. Immutable X will also become a layer-2 partner and platform for GameStop and the Company’s NFT marketplace that is expected to launch later this year. ----- March 23, 2022: - ### [GameStop NFT Marketplace, powered by Loopring L2](https://medium.com/loopring-protocol/gamestop-nft-marketplace-powered-by-loopring-l2-6cdb9289d937) - [Loopring Announces GameStop NFT Beta Launch, Built on LRC L2, Live Now](https://www.gmedd.com/dd/loopring-announces-gamestop-nft-beta-launch-built-on-lrc-l2/) ----- May 23, 2022: - ### [GameStop Launches Wallet for Cryptocurrencies and NFTs](https://news.gamestop.com/news-releases/news-release-details/gamestop-launches-wallet-cryptocurrencies-and-nfts) - [GameStop Launches Wallet for Cryptocurrencies and NFTs](https://www.bloomberg.com/news/articles/2022-05-23/gamestop-launches-wallet-for-crytpocurrencies-and-nfts) ----- July 11, 2022: ### [GameStop Launches NFT Marketplace](https://news.gamestop.com/news-releases/news-release-details/gamestop-launches-nft-marketplace) GameStop announced that it has launched its non-fungible token (“NFT”) marketplace to allow gamers, creators, collectors and other community members to buy, sell and trade NFTs. ----- August 30, 2022: [GameStop releases first set of GMERICA NFTs.](https://twitter.com/GameStopNFT/status/1564210253562056708?t=A3oKFTFQANoqbev8rpIdMQ) ----- September 7, 2022: #### [GameStop Forms Partnership with FTX](https://investor.gamestop.com/news-releases/news-release-details/gamestop-forms-partnership-ftx) ----- November 11, 2022: #### GameStop ends partnership with FTX after FTX collapse. [GameStop is winding down its relationship and pilot gift card marketing partnership with FTX.US and will be providing full refunds to impacted customers. Please reach out to customer service if you purchased a gift card.](https://twitter.com/GameStop/status/1591177707123081232?t=lgIYuNxUmg2OK7xNEiVNZQ) - [Sept 7 to Nov 11, 2022 – GameStop's brief relationship with FTX](https://lemmy.whynotdrs.org/post/363519) ---- March 29, 2023: [GameStop creates second set of GMERICA NFTs.](https://twitter.com/GameStopNFT/status/1641123210442817549) ---- June 1, 2023: [Telos Announces Strategic Collaboration with GameStop to Expand Web3 Gaming](https://finance.yahoo.com/news/telos-announces-strategic-collaboration-gamestop-110000907.html) ---- - June 21, 2023: [Have you heard the news? GameStop Playr will be powered by @elixir_launcher!](https://twitter.com/GameStopNFT/status/1671610024869736448) - June 26, 2023: [GameStop Playr – Elixir and GameStop Partner to Create a New Web3 Gaming Era](https://egamers.io/gamestop-playr-elixir-and-gamestop-partner-to-create-a-new-web3-gaming-era/) - July 22, 2023: #### [Elixir Games to Power GameStop Playr Platform](https://blog.elixir.app/elixir-games-to-power-gamestop-playr-platform/) - - - - August 2, 2023: #### [GameStop (GME) Wallet shutting down as company cites 'regulatory uncertainty of the crypto space'](https://www.shacknews.com/article/136499/gme-gamestop-wallet-shutting-down) - - - - November 1, 2023: Wallet support ended. - - - - January 12, 2024: #### [FYI: GameStop NFT Marketplace winding down on February 2nd, 2024.](https://www.reddit.com/r/Superstonk/comments/194y5fw/fyi_gamestop_nft_marketplace_winding_down_on/) - - - - January 13, 2024 - [GameStop axes its short-lived NFT marketplace as it retreats from crypto](https://finance.yahoo.com/news/gamestop-axes-its-short-lived-nft-marketplace-as-it-retreats-from-crypto-215911813.html) - [GameStop is pulling out of the NFT game.](https://www.theverge.com/2024/1/13/24037045/gamestop-is-pulling-out-of-the-nft-game) ----- February 2, 2024: GameStop NFT Marketplace to shut down.

jersan

8 months ago

•

100%

jersan

8 months ago

•

100%

hey OP.

Just re-found this thread. Noticed that the original image you uploaded is no longer accessible, likely got erased a few months ago when this instance ran into a problem and images got corrupted.

Would you be able to re-upload the original image?

This post gives you cred of being maybe one of the original times that "Plan is not DRS" was stated.

On March 31, 2023, Citadel Advisors LLC produced [an information brochure](https://files.adviserinfo.sec.gov/IAPD/Content/Common/crd_iapd_Brochure.aspx?BRCHR_VRSN_ID=842328) that contains some interesting information. Oddly, it wasn't until around October 2023 when this document was discovered and [posted on reddit](https://www.reddit.com/r/Superstonk/comments/17iq1d4/citadel_advisors_llc_on_meme_stocks_shorts_short/?sort=top). This post goes through the document at some length. ---- There are a bunch of different interesting things that are found in the information brochure. For example, under the section titled **Item 8 – Methods of Analysis, Investment Strategies and Risk of Loss - General Risks**: > ### Short Positions > A short sale of an investment instrument entails the risk of **an unlimited risk of loss** as there is no limit on how much the market price of that investment instrument may increase before the short position is closed. As a result, short sales can result in significant losses to a Fund. > ...purchasing investment instruments to close out a short position in such investment instruments can itself cause the price of the investment instrument to rise further, increasing losses. > Risks of short selling are increased by actions aimed at creating “short squeezes” (e.g., increasing the price of specific securities for which there are known or perceived substantial short positions across the market, resulting in short sellers closing out their short positions in such securities at the demand of lenders or to curb further potential losses, which, in turn, further increases the price of the specific securities). **Hedge funds that trade securities that are considered “meme stocks” may be particularly prone to short squeezes related to such stocks.** ----- Citadel basically confirms things that GME investors have been speculating about for a while. I assume that the purpose of Citadel producing this brochure is for legal liability reasons. When they say it, it's just good business. But when GME investors talk about it, we're called all kinds of derogatory words that insinuate we lack intelligence and knowledge and that we're delusional. The writing is on the wall.

www.businessinsider.com

www.businessinsider.com

This article is based on this original report by [Apollo Research](https://www.apolloresearch.ai/). [Technical Report: Large Language Models can Strategically Deceive their Users when Put Under Pressure](https://arxiv.org/pdf/2311.07590.pdf) from the abstract: "Within this environment, the [AI model] obtains an insider tip about a lucrative stock trade and acts upon it despite knowing that insider trading is disapproved of by company management. When reporting to its manager, the [AI model] consistently hides the genuine reasons behind its trading decision." - - - - "Apollo Research is a fiscally sponsored project of [Rethink Priorities](https://projects.propublica.org/nonprofits/organizations/843896318)" - - - - businessinsider article [archive.org paywall bypass](https://web.archive.org/web/20240101093216/https://www.businessinsider.com/ai-deceive-users-insider-trading-study-gpt-2023-12) TLDR: - Researchers created an AI stock trader to see if it would engage in insider trading under pressure. - They found the AI did — and also lied to its hypothetical manager about why it made its decision. - The AI had been told that insider trading was illegal.

Recently there have been some great discussions about the important distinction between Plan shares (aka DirectStock aka DSPP), and DRS shares. - - - - ## Plan is not DRS. - [Why are DRS numbers stagnant? Exploring the possibilities ... Plan is not DRS](https://lemmy.whynotdrs.org/post/487756) - post by Chives on December 8 - [Plan is not DRS](https://www.reddit.com/r/Superstonk/comments/18onddp/plan_is_not_drs/) - post on superstonk on December 22 by jackofspades123 based on the original post by Chives. Regarding the distinction between Plan shares (not DRS) and DRS shares, the term "plan versus book" (or "book versus plan") is a term often used to refer to this. In the context of holding DRSd shares of GME with Computershare, if your shares are DRS shares, it will show as 'Book' under share type, and if your shares are in Plan (not DRS), it will show as 'Plan holdings' under Share Type.  This is likely the original source of the term "Plan versus Book", to address the distinction between these two types of holdings in a Computershare account. - - - - ## "Plan versus Book" is a misnomer. "Book" means [Book-Entry (or Paperless) Securities](https://www.investopedia.com/terms/b/bookentrysecurities.asp). "Book-entry securities are investments such as stocks and bonds whose ownership is recorded electronically." That's it. The following are examples of book-entry securities: - shares of GME in a brokerage account - shares of GME in DSPP / Plan through Computershare - shares of GME in DRS. All of these types of holding are recorded electronically and they are all book-entry. So, when the term "Plan versus Book" is used, it is a misnomer because plan shares are book-entry shares, and "Book", usually intended to refer to "pure DRS" in this context, also just means book-entry shares. Both types are book-entry, but they are not both DRS. - - - - TLDR: ## "Plan versus DRS" is more accurate "Plan versus DRS" is a term that more accurately refers to the distinction of shares held in Plan (book-entry, not DRS) and shares held in DRS (book-entry, DRS).

Inflation is a serious issue that is affecting practically everybody in some way or another. On numerous occasions Ryan Cohen has publicly commented (tweeted) on the issue of inflation and its causes. - - - - ## Ryan Cohen on inflation - [February 9, 2022:](https://twitter.com/ryancohen/status/1491608576175099908) "Who will be the piñata for all this inflation? 🤨" - [February 11, 2022:](https://twitter.com/ryancohen/status/1492254050661847044) "The reverberations of fiscal and monetary policy are likely to be more severe to humans than any climate or societal disaster 💀" - [March 31, 2022:](https://twitter.com/ryancohen/status/1509582599878029322) (indirectly related to inflation) "gas prices are outrageous. Wonder if BCG has a view…" - [April 20, 2022](https://twitter.com/ryancohen/status/1516962826962698241) "Fed prints 80% of all dollars in existence since 2020. Causes record inflation. Damn it Russia" - [April 21, 2022:](https://twitter.com/ryancohen/status/1517324363351035904) "Party extremism and divisiveness, deglobalization, civil unrest and inflation are byproducts of govts printing huge sums of money" - [May 11, 2022:](https://twitter.com/ryancohen/status/1524470193157779458) "I’m really upset with Putin for causing all this inflation" - [June 10, 2022 ](https://twitter.com/ryancohen/status/1535247081249595392) Poll: "Did coronavirus lockdowns and economic stimulus spark inflation?" - [June 17, 2022](https://twitter.com/ryancohen/status/1537744455867981824) "Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man" - [June 27, 2022](https://twitter.com/ryancohen/status/1541556841133445120) "Wall Street charges lofty fees, doesn’t risk its own money, consistently underperforms and wins regardless of how the economy does. Meanwhile, Main Street faces inflation and a growing wealth gap. What’s the solution?" - [August 10, 2022](https://twitter.com/ryancohen/status/1557541659323248640) "if we print a few trillion more, it should bring inflation down #taxtherich #wealthtax" - [October 11, 2022](https://twitter.com/ryancohen/status/1579973046206894081) "Low interest rates may prove to be like easy sex — tempting but possibly fatal" - [December 30, 2022](https://twitter.com/ryancohen/status/1608920756100141057) "Has inflation cured the land from covid?" - [May 2, 2023](https://twitter.com/ryancohen/status/1653455058745294854) "The Fed may have to choose between fighting inflation or bank contagion" - [October 25, 2023](https://twitter.com/ryancohen/status/1717337273262313603?s=46&t=1kgf16QwDp2Ydp9mdZLBYw) “The most important thing to remember is that inflation is not an act of God, that inflation is not a catastrophe of the elements or a disease that comes like the plague. Inflation is a policy.” -- Ludwig von Mises

jersan

9 months ago

•

100%

jersan

9 months ago

•

100%

I imagine also that WADU, which is listening and watching and analyzing literally everything that every employee is doing at all times, probably also has a view on all interpersonal relationships. WADU probably knows who is friendly with who, who is feuding with who, who might have emotional feelings for who, which employees are having a secret affair that isn't out in the open, but WADU knows.

WADU can probably detect many / all facets of an employee's personality, e.g. whether an employee is passive / assertive / aggressive. Information that managers could use to best maximize their interactions with their employee knowing with incredible data models how best to handle such a person.

WADU probably has an accurate map of the entire social hierarchy. Who is the most well-liked and who is the least well-liked, who has interpersonal influence into other employees, and so on.

It's kind of scary to imagine the incredible power that a system like WADU gives to the management at the company. You could be an employee with a secret that nobody else could possibly know about. You get called in to your manager's office to have a conversation. You aren't even aware that WADU already knows all about your secret, and has informed your manager, who is about to ask you questions to see how far you will lie to cover up the secret that they already know about.

What a horrifying employment environment. It is a great example of how power corrupts, or how power enables corruption. This is what I would call a corrupt work environment. The employees are treated like robots, all of their behavior is measured and analyzed, against all of the measurements of all the other robot employees. Sure, they probably make good salaries, but one of the conditions of employment is that they must necessarily sell their humanity to the employer.

jersan

9 months ago

•

100%

jersan

9 months ago

•

100%

On the subject of monitoring employee "bio-metrics", I'm just imagining that the information dashboards they have is almost like a game of the Sims. A manager can probably click on any one of their subordinates and get a live data model that gives all kinds of information.

"This employee really needs to use the toilet, it has been 3 hours since the last washroom break"

"This employee has gone to the washroom 4 times this morning. Other data indicators suggest that this employee might have a medical condition"

"This employee will need a fresh cup of coffee within 30 minutes, based on the data of the regularity of coffee consumption"

It all kind of reminds me of this joke:

The doctor says, "I have this great new machine that's coming in tomorrow. You give me a urine sample and the machine will diagnose exactly what's wrong with you. Bring me a sample tomorrow and we'll run it through."

Ron thinks this is a load of crap so he decides to play a trick on the doctor. He collects urine samples from his wife, his teenage daughter, his young son, and his dog, and finally, jerks off into the vial. He takes it to the doctor and can hardly contain his smirk when the doctor pours it in the machine.

"Huh", says the doctor. "These are the strangest test results I've ever seen."

"Really?", says Ron. "What does it say?"

"It says your wife has herpes, your daughter is pregnant, your son isn't yours, your dog has worms and if you don't quit jerking off you're never going to get rid of that sore wrist."

in all seriousness, it would not surprise me if JP Morgan had sampling devices built in to their plumbing that was analyzing employee urine. Lot's of valuable information in urine. It sounds ridiculous, and it is. But this is the world we live in

www.businessinsider.com

www.businessinsider.com