Consider this screenshot of a meme from Roaring Kitty. It comes from time 33:25 in the video compilation of his memes [0]. Notice the cartoon character Goofy inserted into the live action film. The detective is deep in thought while staring at Goofy. Then the detective drops his coffee mug –– shattering it on the floor. This is a reference to a moderator of r/walltreetbets. He posted a photo from a Christmas party at Walt Disney World exclusively for Citadel employees. The implication being that this moderator is a Citadel employee at the party [1] [2]. r/superstonk reposts the photo, and riot of posts ensues. Mods must have been out for Christmas. Maybe also at the Citadel party? And then the next day, every post and every comment on this topic is deleted. “This content is not appropriate.” I confirmed on reveddit at the time. Later the moderator at the Citadel party claimed that he was not a Citadel employee –– but rather a Walt Disney World employee playing Goofy at the party. [0] https://x.com/roaringpika/status/1792256419544055876 [1] https://lemmy.world/comment/5020083 [2] https://x.com/john55144586/status/1602405226614558728

“Roaring Kitty, once I decided to follow you, you promised to walk with me all the way. But during the most troublesome times, there is only one set of footprints. When I needed you most, why did you leave me?” “My precious child, during your times of trial and suffering, when you see only one set of footprints, it was then that I carried you.” (original content)

In this tweet from @TheRoaringKitty [0], a pizza is repeatedly sliced into thinner and thinner slices. This is a reference to the reply from New York Federal Reserve to the Clearing and Legal Certainty Group from the European Commission [1]. When you buy stock, you don't actually get stock –– just a security entitlement. This is a pro-rata share of the stock held by the intermediary. When other shareholders DRS, then their security entitlements at the intermediary become real stock at the transfer agent. So the intermediary is left with less and less stock, and your pro rata share gets smaller and smaller. Like the thinner and thinner slices of pizza. [0] https://twitter.com/TheRoaringKitty/status/1790770363627921776 [1] https://archive.org/details/ec-clearing-questionnaire

AnimorphFan1996 5 months ago • 100%

Thank you for calculating this, @Zuberi.

Tennessee House Bill 2806 / Senate Bill 2640 amends the Uniform Commercial Code to: - Move the jurisdiction for security entitlements to Tennessee - Give entitlement holders priority over secured creditors of intermediaries The civil justice subcommittee hearing features testimony from: - David Webb –– author of [The Great Taking](https://thegreattaking.com/) - Don Grande –– private practice attorney - Andy Guggenheim –– Securities Industry and Financial Markets Association - Tim Amos –– uniform law commissioner Andy Guggenheim: "While holding securities in street name is the most common choice for investors, they do have alternatives for holding securities in other ways if they prefer including physical form via stock certificate when that is available by the issuing company." (He won't say the word DRS!) David Webb: "DTCC itself is planning to start up and pre-fund a new central clearing counterparty when one of the existing ones fails. The industry is talking about the very real possibility that major central counterparties will fail." Related Links: - [Bill Text](https://www.capitol.tn.gov/Bills/113/Amend/SA0728.pdf) - [Legislative History](https://wapp.capitol.tn.gov/apps/BillInfo/default.aspx?BillNumber=HB2806) - [Video of the Civil Justice Subcommittee Hearing](https://www.youtube.com/watch?v=ldNdW3_00gI) - [EU Clearing and Settlement Legal Certainty Group Questionnaire](https://archive.org/details/ec-clearing-questionnaire)

AnimorphFan1996 5 months ago • 100%

r/superstonk's loss is Lemmy's gain!

sandersonclay.com

sandersonclay.com

GameStop’s earnings report: 15 things you might have missed GameStop published their latest form 10-K on March 26, 2024. While the filing date was on March 26, the document date is February 3, 2024. In this article we dive deeper into the filing and highlight some interesting bits you might have missed. You can find the form or read along with us right here! Our merchandise? Collectibles, which included digital asset wallet and NFT marketplace activities On page 2 of the filing GameStop mentions their merchandise, which includes hardware, accessories, software, and collectibles. Under collectibles they mention their collectibles also included the digital asset wallet and the NFT marketplace activities. “However, both activities were wound down in the fourth quarter of 2023.” GameStop refurbishes products and recycles and achieved a reduction in YoY carbon emissions in excess of 10% Also on page 2 there is mention of sustainability. “In 2023 alone, through our U.S. refurbishment center, we refurbished over 1.1 million software discs and over 3.0 million consumer electronic devices, and recycled over 0.6 million pounds of e-waste.” States with the most and least store locations Based on the map, one could say there are more GameStop locations on the east coast of the US and fewer in states that are more distant. GameStop’s competition According to the filing, GameStop says their competitors in the USA (among others) are: - Walmart - Target - Best Buy - Amazon In Europe they are FNAC-Darty, Media Markt-Saturn, Amazon, and major hypermarket chains like Carrefour. In Australia: JB HiFi, Big W, Target, and Amazon. Every region has Amazon as GameStop’s competitor. This goes hand in hand with Chewy going head-to-head with Amazon and GameStop wanting to become an Amazon-killer. Interesting reminder: Matt Furlong, former GameStop CEO was an executive at Amazon. Scholarships GameStop says they have provided more than $800,000 in scholarships, as per page 5. Holiday season can have a big impact on financial results On page 7, under the RISK FACTORS item, GameStop mentions a potential reason why Q4 2023 revenue was less than expected. “Our business, like that of many retailers, is seasonal, with a major portion of our sales and operating profit realized during the fourth quarter of fiscal 2023. (…) Any adverse trend in sales during the holiday selling season could lower our results of operations for the fourth quarter and the entire fiscal year and adversely impact our liquidity.” Risks related to their common stock include some interesting things Starting on page 12, GameStop lists risks related to their common stock. Some notable parts: - “Short squeezes”. “A large proportion of our Class A Common Stock has been and may continue to be traded by short sellers which may increase the likelihood that our Class A Common Stock will be the target of a short squeeze. A short squeeze has previously led and could continue to lead to volatile price movements in shares of our Class A Common Stock that are unrelated or disproportionate to our operating performance or prospects and, once investors purchase the shares of our Class A Common Stock necessary to cover their short positions, the price of our Class A Common Stock may rapidly decline. Stockholders that purchase shares of our Class A Common Stock during a short squeeze may lose a significant portion of their investment.” - Comments by analysts, blogs, articles, message boards, and social and other media. - Large stockholders exiting their position or an increase or decrease in the short interest. - Actual or anticipated fluctuations in our financial and operating results. - Acquisition costs and the integration of companies we acquire or invest in. - The costs associated with the exit of unprofitable markets, businesses or stores. - Some interesting aspects, which are thoroughly known by GameStop’s retail investors. 2024 has the most amount of store leases expiring At total of 1,350 lease terms will expire in fiscal 2024. This offers flexibility for extension or relocation. Size of offices and distribution facilities Office and distribution facilities total an approximate of 2 million square feet, which is the size of this: Or almost as big as Grand Central Station. Does not anticipate a dividend Written on page 17, GameStop says “During the past four fiscal years, we have not declared, and do not anticipate declaring in the near term, dividends on shares of our Class A Common Stock.” Simplified stock chart on page 17 Thanks GameStop, this is sure to raise questions when asking unknowing traders and investors what that big spike in 2021 was! GameStop also provides a convenient table to see how the stock’s price has fared against the general market: GameStop mentions the market price of its stock has been extremely volatile due to circumstances, including a short squeeze “As noted above under the heading “Risk Factors — Risk Related to Our Common Stock”, the market price of our Class A Common Stock has been extremely volatile due to circumstances outside of our control, including a short squeeze that led to volatile price movements that were unrelated or disproportionate to our operating performance.” (Page 18) Cash on hand is actually $921.7 million Though in total, GameStop has control over more than $1.1 billion and $475.7 of available borrowing capacity under their revolving credit facilities, but that 1.1 billion includes marketable securities of $277.6 million. GameStop mentions this on page 22. The only remaining debt is $28.5 million and consists of six separate unsecured term loans They are held by Micromania SAS, the French subsidiary of GameStop. The total amount was €40 million (just over $42 million) in fiscal 2021. You can find it on page 22. Advertising expenses decreased a lot “Advertising expenses for fiscal 2023, 2022 and 2021 totaled $39.3 million, $75.0 million and $93.6 million, respectively.” This is stated on page 44. We might have easily missed more interesting or important information. That’s no surprise, seeing as how big reports can be. Which things you read in the 10-K were the most surprising or interesting to you? Let us know in a comment!

AnimorphFan1996 5 months ago • 100%

I would only have noticed one of the two hidden names if not for the animation!

AnimorphFan1996 5 months ago • 100%

I love the Pac-Man meme!

This rule change (approved by the SEC) prevents issuers (such as GameStop) from withdrawing their shares from the DTC. > Recently a number of issuers of securities have independently requested that DTC withdraw from the depository all securities issued by them. > As explained in further detail by many of the commenters opposing DTC's proposal, the issuers making these requests have alleged that their securities have been the target of manipulative short sellers. > DTC's proposed rule change provides that upon receipt of a withdrawal request from an issuer, DTC will take the following actions: > > (1) DTC will issue an Important Notice notifying its participants of the receipt of the withdrawal request from the issuer and reminding participants that they can utilize DTC's withdrawal procedures if they wish to withdraw their securities from DTC; and > > (2) DTC will process withdrawal requests submitted by participants in the ordinary course of business but will not effectuate withdrawals based upon a request from the issuer."

AnimorphFan1996 6 months ago • 100%

"GameStop's DRS Reporting History" from DRSGME shows the change in the DRS Reporting Language over time.

AnimorphFan1996 6 months ago • 100%

AnimorphFan1996 6 months ago • 100%

Since you're making so much money on AI stocks, you don't need to waste your time posting about GameStop. Just hire someone else to tell us to sell.

knowyourmeme.com

knowyourmeme.com

- Wired: [Ryan Cohen is dying.](https://lemmy.whynotdrs.org/post/1126833) - Tired: [GameStop is dying.](https://www.businessinsider.com/gamestop-failing-store-tour-shows-flawed-business-2019-8?op=1) - Expired: [Bitcoin is dying.](https://99bitcoins.com/bitcoin-obituaries/) Explanation of the [Wired / Tired / Expired meme](https://knowyourmeme.com/memes/tired-wired) from Know Your Meme.

AnimorphFan1996 8 months ago • 100%

Good meme.

AnimorphFan1996 8 months ago • 100%

It certainly seems like the moderators are trying to influence discussions of the difference between DRS and Plan.

AnimorphFan1996 8 months ago • 100%

Good find!

hdtoday.tv

hdtoday.tv

"Risky Bets" is Episode 1 of the documentary mini-series *Gaming Wall Street*. This post bypasses the HBO Max paywall. "In 2021, an all-out war around GameStop breaks out when a group of internet investors band together to skyrocket the stock price of the flailing video game company –– upending Wall Street in the process." - [*Gaming Wall Street: This Game Has a Dark Side* (official website)](https://gamingwallstreet.org/) - [*Gaming Wall Street* on Wikipedia](https://en.wikipedia.org/wiki/Gaming_Wall_Street) - [*Gaming Wall Street* Episode List on IMDb](https://www.imdb.com/title/tt18332840/episodes/) - ["I naked short sold stocks every single day." (video clip)](https://lemmy.whynotdrs.org/post/197163)

AnimorphFan1996 9 months ago • 100%

For a dramatization of the Panama Papers, watch the comedy-drama film The Laundromat streaming on Netflix.

AnimorphFan1996 9 months ago • 100%

I don’t think a NFT dividend would work. It was tried once when Overstock was shorted and it flopped.

Overstock's digital dividend story: "Overstock announced a plan to issue a digital dividend in Sept. ’19. After a legal fight with short sellers, the issuance took place on May 19th, ’20. Overstock share price began to climb prior to issuance and then sky-rocketed just after, gaining near 25x within 6 months."

AnimorphFan1996 9 months ago • 100%

How about exchanging links with a GameStop-related community on a different Lemmy server? (Even if there is no other community specifically focused on DRS.) This could be a kind of social federation between related communities –– in addition to the baseline technological federation built into Lemmy.

AnimorphFan1996 9 months ago • 100%

That's a good take. After just 2 - 3 years, people ask "Wen moon?" Compare to other corporate turnarounds or short seller conflicts.

AnimorphFan1996 9 months ago • 100%

Agreed!

upsidechronicles.com

upsidechronicles.com

**Gamestop’s data reporting ‘idiosyncrasies’ warrant a closer look** BY JACK TAZMAN DECEMBER 2, 2021 Data anomalies flagged by GameStop investors have required corrective action representing over 350 million GameStop shares. Say what you want about GameStop’s loyal individual investor base, they are definitely keeping a close eye on things. Every SEC filing, every court case, every job board, every news release, every GitHub update – any bit of information that has to do with their favorite stock is quickly detected and discussed by the colossal following in various GameStop-oriented subreddits. They aren’t the only ones tirelessly checking the forums for new information. Topics that gain traction in the individual investor community often find their way into headlines of mainstream media sites including Motley Fool, MarketWatch, Investor’s Place, CNBC, and others. How strange then that the very community these publications depict as reckless, mindless hype followers is one that they depend on for news. For almost a year now, mainstream financial publications publish several articles per week with news and updates plucked straight from GameStop stockholder community. Even more perplexingly, these institutional publications’ articles only address these topics to dismiss them as invalid without providing any real basis for doing so. Most recently, the GME investor base discovered something in Fidelity’s data that raised questions. The response by the media was revealing to say the least. It falls in line with an alarming trend of massive GameStop glitches in data reporting. **Fidelity’s GameStop glitch: Shares available to borrow** On Monday, November 29, 2021, the top post across several GameStop-focused subreddits centered around the number of shares stockbroker Fidelity listed as ‘available to borrow.’ Stock brokers lend their account holders shares out to short sellers who in turn use them to artificially distort supply-demand dynamics with the goal of driving stock prices down. Short selling has been at the center of the GameStop saga since long before it caught significant traction with retail investors in late 2020. Fidelity had mistakenly listed 13,767,545 GameStop shares as available to borrow to short sellers. That figure represents more than 20% of GameStop’s total issued shares. Fidelity is just one broker. Interactive Brokers, for example, listed 500,000 of their account holders’ shares as ‘available to borrow’ that day as well. Almost fourteen million shares is significantly above Fidelity’s average range of lendable GameStop shares, which hovered between one to three million shares for most of 2021. GameStop shareholders had a very reasonable question: Where did Fidelity get these millions of extra shares, which the broker itself labels as ‘hard to borrow’? **MarketWatch, the Wall Street megaphone** True to form, the financial media responded to what they had read in GameStop-centered subreddits like r/Superstonk and r/GME about the Fidelity lendable shares. MarketWatch writer Thornton McEnery writes that it was “pretty cringey to see that a growing band of retail Apes spent much of Tuesday morning ignoring the macro bloodbath across indexes and combing through what they thought looked like a fishy discrepancy on Fidelity’s platform, regarding GameStop,” in an opinion piece published eight hours after the topic rose to the top of GameStop-oriented subreddits. He then goes on to quote then ridicule various Redditor comments and points of discussion on the matter. The irony, hypocrisy, and cringiness of the piece must have been lost on McEnery. Additionally, McEnery is dismissive of the $2.2 billion, 11 million share discrepancy the GameStop shareholders flagged, describing it as “what they thought looked like a fishy discrepancy.” He goes on to clear the air with the satisfying and purely speculative explanation: It might have just been a harmless case of someone “fat-fingers a keystroke and few zeroes get added.” He goes on to say that it “happens all the time, even in the highest echelons of finance.” Apparently, individual GameStop investors questioning a 20%-of-the-float error as something that warranted an explanation seemed amateurish and beneath McEnery to offer any real information on. Nothing says quality reporting like describing a $2.2 billion data discrepancy as an “oopsie,” then redirecting the narrative to discrediting the people who discovered the discrepancy in the first place. **Fidelity responds** But in case MarketWatch‘s explanation left something to be desired for GameStop shareholders – or anyone with a preference for meaningful financial reporting and accountability – Fidelity would eventually respond to the numerous inquiries regarding the mysterious 11 million GameStop shares listed as available to borrow. However, it was less of an explanation insomuch as it was a recap of events followed by a shift of blame for the glitch that represents about 13% of GameStop’s total market cap. According to a response written by Scott Ignall, Fidelity’s Head of Retail Brokerage, the cause of the 11 million share “data anomaly” was that “one of [Fidelity’s] counter-parties provided an erroneous number for GME.” In another post about the GameStop data glitch, Fidelity’s official response notes “…that error caused the number of short-able shares to be overestimated by approximately 11,000,000.” That’s a pretty big overestimation! So it wasn’t “what they thought looked like a fishy discrepancy” after all. It was a bona fide, massive, $2.2 billion GameStop glitch that was only corrected after GameStop individual investors noticed it and raised the issue with Fidelity. Moreover, it was yet another glitch that benefited short sellers and brokers and hurt real GameStop investors, as all GameStop glitches curiously do. Outraged GameStop individual investors pressed Fidelity for more information. Fidelity later posted the following reply to their subreddit: "We have researched the issue with our lending services. In looking into the issue, it was found that one of the counterparties that may provide us shares to short had entered an incorrect number of shares available to short. That error caused the number of shortable shares to be overestimated by approximately 11,000,000. We have rectified the issue and the trade ticket should reflect the correct amount of shares that maybe available to short, which is approximately 2 million." –– u/fidelityinvestments In another response post from Fidelity, the company said: “After researching the volume with our lending services team, we were able to identify that the root cause was an incorrect entry of the number of shares available to short by one of our external counterparties. the issue was fixed by 12:10pm et today. the gme shares available to short is now correct on the trade ticket.” –– Fidelity response to GameStop glitch Interestingly, that day, the stock had been in a steady decline until precisely 12:10 p.m., at which point the stock bottomed out, the reversed trend, regained all the losses up through 12:10 p.m., and ended the day up 1.15%. **GameStop glitches are frequent and large** MarketWatch's coverage of the Fidelity fiasco is right in one regard. When it comes to GameStop, these types of data discrepancies – or “oopsies” – do indeed happen “all the time.” But where MarketWatch is wrong is that these glitches are frivolous and investors should pay no mind. To better understand why GameStop shareholders are so committed to their ongoing due diligence and thesis about the stock, context is key. Monday’s Fidelity fiasco was hardly the first massive discrepancy investors discovered in GameStop stock trading activity. In fact, it wasn’t even the third largest by share volume. There were two other well-documented “glitches” involving large volumes of GameStop stock appearing in the data. Despite being brought to the attention and indeed, corrected by various data providers and brokers, none has been able to provide a satisfactory explanation as to why the discrepancy occurred in the first place. **One million deep out-of-the-money GameStop puts in the Bloomberg Terminal, July 2021** Back in late July, another major GameStop glitch was observed by individual investors. This time, it was first noticed in a Bloomberg Terminal. Two Brazilian hedge funds, Constansia Investimentos and Kapitalo Investimentos, popped up for the first time in the Terminal’s GameStop options data on July 28, 2021. Both firms were an holding exceptionally high volume of put options contracts (put options contracts bet the stock price will go down) on GameStop stock. Between the two of them, they held almost 1.1 million put option contracts. To put that in to perspective, one option contract represents 100 shares. Those 1.1 million contracts represent 110 million GameStop shares – 143% of the total number of GameStop shares in existence. But by the next trading day, July 29, 2021, both firms and their massive put positions were gone from the Terminal. However, also on July 29, 2021, a new name popped up in the Terminal data on GameStop’s option chain. This newcomer also carried a massive put position: 540,000 contracts. Like the Brazilian firms, this GME options-chain guest star would only stay in the Bloomberg Terminal for one day. By July 30, 2021, they too had vanished. That stealthy one-day appearance that immediately followed the Brazilian firms cameos was none other than Credit Suisse – the very neutral champions of financial discretion and privacy. The three firms, holding over 1.6 million put contracts representing more than double the total GameStop shares oustanding, came and went in a 48-hour time frame. **One GameStop individual investor’s due diligence** One inquisitive investor did what many investors once thought the financial media might do. They looked into it. Redditor u/lawsondt emailed the Bloomberg Terminal support team about the one-day cameo firms and the massive GameStop put positions they held. In their initial outreach to the Bloomberg support team, the Redditor notes several peculiarities, as well as some strange commonalities, the three fruit-fly firms had. Firstly, all three firms carried massive GameStop put positions. Secondly, they were the only three institutional put holders that reported strike prices and expiration dates on their put positions. Additionally, all three only appeared in the Bloomberg terminal for one day. “Can you please explain what happened with the GME put positions on July 28 and July 31, 2021?” u/lawsondt writes to Bloomberg’s support team after outlining what they’d witnessed in the Terminal. “The ownership of those GameStop options by those Brazilian funds was a bug and has been addressed,” a Bloomberg Portfolios Data Team representative responds, later adding: “None of those puts should have been displayed as they were not puts on GME…Those 540,000 puts [Credit Suisse’s holdings] were not supposed to reference GME and be on this page in the first place, so they were removed. This issue was isolated to GME.” While the Bloomberg representative explains how Terminal data is collected, the explanation doesn’t address how three different firms holding hundreds of thousands of GME put positions would briefly and erroneously register in the data. The Bloomberg bug, Fidelity fiasco, and MarketWatch‘s ‘oopsies’ are insufficient explanations for the GameStop glitches that leave much to be desired, raising more questions than answers. The trend appears to be: GameStop investors discover these glitches and raise concern, the numbers are quickly “corrected,” and no meaningful explanation is given. Whenever GameStop individual investors press for answers, they are routinely delayed for time, given fluff answers, and passed around company representatives. Despite Fidelity and Bloomberg reactively making massive corrections – representing more than double GameStop’s total shares outstanding between them – the financial media either doesn’t report on it at all, or portrays individual investors as mistaken and reactionary in their findings. But as Upside Chronicles recently learned, this would not be the last of u/lawsondt’s correspondence with the Bloomberg support team, nor of GameStop’s chronic ‘data glitch’ problems. **Yahoo! Finance GameStop Glitch, September 10, 2021 – September 13, 2021** On September 12, 2021, a commotion broke through GameStop subreddits. Another massive discrepancy had been discovered and confirmed by numerous GameStop individual investors on Reddit. This would be the biggest GameStop glitch reported to date. That Sunday night, Yahoo Finance! reported total shares outstanding for GameStop as 249.51 million shares. According to GameStop’s most recent 10-Q filing, the company has only ever officially issued 76.49 million shares. Yahoo! Finance’s data was over-reporting the shares outstanding by 226%. Short selling adds artificial (borrowed) shares into circulation. It stands to reason then, that the additional 173 million shares over the company’s shares outstanding were borrowed shares in circulation – short positions. **Shifts in GameStop’s option chain** Upside Chronicles obtained historical options chain data for the Friday before and Monday after the Yahoo! Finance glitch was discovered. On Friday, September 10, 2021, the total open interest (all strike prices, all expirations) for GameStop call contracts was 298,063. Total open interest on puts at opening was 568,900. By closing on that day, the open interest call-put numbers stayed exactly the same. By opening of the next trading day, Monday, September 13, 2021, total open interest on calls had skyrocketed to 529,089. Total open interest on put contracts had dropped to 529,058. At market open that Monday, the total open interest for call and put contract were almost one to one. Yahoo! Finance’s data was corrected to a much more “in line” float of 61.2 million. By the end of Monday’s trading session, there were 768,774 open interest call contracts on the GameStop options chain – a 257% increase in calls across the entire chain within one trading day. **Another GameStop glitch in the Bloomberg terminal** That weekend, u/lawsondt was looking at Bloomberg Terminal data on GameStop options. And once again, they noticed something. They resume correspondence with Bloomberg’s support team. “More put options appeared than disappeared over the last 24 hours for GameStop stock,” u/lawsondt writes. “…In full disclosure, there have been several SEC complaints filed alleging illegal options for $GME stock used to reset Reg SHO Close-Out Obligations as described by the SEC on August 9, 2013.” Five business days later, he got a response. Bloomberg would change the representative looking into the matter. From that point on, Bloomberg only responds to u/lawsondt’s follow ups with requests for more time. By October 1st, they still had not provided an answer. Full correspondence here. **GameStop glitch: Totals and timelines** Between the Fidelity fiasco, the Bloomberg Terminal “bug,” and the Yahoo! Finance data glitch, the leading finance industry data providers have corrected errors that reflect a total of 351 million GameStop shares – more than 450% of the total GameStop shares in existence. At GameStop’s current trading value (approximately $180), the total sum of “oopsies” and “bugs” amounts to more than $63 billion worth of data glitches relating to GameStop stock in the last four months alone. GameStop investors are right to raise concern and continue their due diligence, as all investors should in anything they are invested in. Ultimately, these were not “what they thought looked like a fishy discrepancy.” On the contrary, what GameStop investors have discovered multiple, concrete, data-backed fishy discrepancies that required corrective action by Bloomberg, Yahoo! Finance, and Fidelity once GameStop individual investors asked about them. **Of concern to all investors** Glitches of this magnitude aren’t just the concern of GameStop investors – they should be of concern to all investors, especially if as MarketWatch states, “it happens all the time.” How can anyone trust the markets and those that run them with this level of “error” occurring being the best-case scenario? Why is it that these errors seem to always be one-sided? Were they truly snafus, it would stand to reason that every now and again, they would happen in a way that favors GameStop’s real investor base – not consistently for the short sellers trying to erode the value of the company. Dark pool activity has increased by 400% over historical averages beginning in 2021. Share volume trading hands exploded around the same time. The average number of shares traded per quarter in 2020 was about 70 billion. Starting in Q1 of 2021, that number skyrocketed to approximately 500 billion shares per quarter – a seven fold increase, according to FINRA data. That means that GameStop individual investors have been and will remain at significant information disadvantage as Wall Street pulls more and more trading activity into obfuscation. [See Upside Chronicles' dark pool report here.] The level of secrecy in the so-called public markets is alarming. Markets needs more accountability and transparency. While GameStop investors might be keeping the closest eye on every metric relating to the stock, if it can happen here at this magnitude, it can happen elsewhere to this magnitude. The financial sector seems to have forgotten that these aren’t just numbers on a screen and games – what happens in the market affects real people’s lives, jobs, savings, health, quality of life, and American prosperity at large. The market needs more watchdog groups like the GameStop individual investor base, not less of them. That the groups responsible for investigating illegal activity in the markets – the SEC and financial press – have either ignored these issues or worse, ridiculed those doing their jobs for them, should be enough for any investor with any semblance of faith left in American financial markets to pull the fire alarm. Where the GameStop saga will go from here remains to be seen. But one thing does seem certain: It’s not over yet. **Jack Tazman** Jack Tazman is a Baltimore, Maryland native. He attended Washington University where he studied political science. Since then, he worked as a writer for various national news organizations specializing in politics and policy. He now resides in New York City as a freelance writer and political consultant.

www.youtube.com

www.youtube.com

AnimorphFan1996 9 months ago • 90%

Sometimes, not always, they are a zero-sum game: one person’s win is another person’s defeat.

Thanks for your comment –– you make some good points. While I agree that this conflict will have a winner and a loser, considering all of the stakeholders, I disagree that it is a zero-sum game. If the bears win, then a $5 billion company goes out of business, and 25,000 employees lose their jobs (negative sum). If the bulls win, then GameStop continues to provide value to customers –– and potentially enters into emerging markets like NFTs (positive sum).

AnimorphFan1996 9 months ago • 100%

How quickly did you expect Ryan Cohen to turn GameStop around? The conflict against short sellers of Herbalife took five years ("Bill Ackman Surrenders in His Five-Year War Against Herbalife").

AnimorphFan1996 9 months ago • 100%

The check and balance on abuse of moderation is the right to migrate to a different community –– "voting with your feet." Consider the meme "Apes during the last Great Ape Migration to Superstonk" (and many other memes). r/superstonk has infringed on this right by censoring references to Lemmy. DRSGME / WhyDRS has strengthened this right by using open source software, federating with other servers, and providing backups to certain users. Another way to strengthen the right to migration is to link to a related but credibly independent community. Some subreddits link to related subreddits in the sidebar. Judging from this comment by @jersan, theppshow community may or may not be sufficiently similar or sufficiently active. Can you think of a related community independent of the DRS Team? On Lemmy, Reddit, Twitter, or any platform.

AnimorphFan1996 9 months ago • 100%

I noticed in hindsight that this post is a repost. Credit to @Zuberi for posting "Jon Stewart, Gary Gensler spar over SEC oversight: ‘It’s not a level playing field,’ Gensler says" about a month ago. I didn't find the original post when searching because it used a different title.

I came across the article ["Bill Ackman Surrenders in His Five-Year War Against Herbalife"](https://www.wsj.com/articles/bill-ackman-surrenders-his-in-five-year-war-against-herbalife-1519854456) in the Wall Street Journal. The hedge fund Pershing Square Capital Management led by Bill Ackman short sold the multi-level marketing and dietary supplement corporation Herbalife. Bill Ackman argued that Herbalife was a pyramid scheme, and its stock price would go to zero. Activist investor Carl Icahn of Icahn Enterprises invested in Herbalife –– becoming its biggest shareholder. Short seller versus activist investor. A live television shouting match between Ackman and Icahn. Compare to the GameStop short squeeze. GameStop CEO Ryan Cohen has even been connected with Carl Icahn (["Ryan Cohen and Carl Icahn Meetup Energizes GameStop Bulls Amid Yet Another Bear Market Rally"](https://wccftech.com/ryan-cohen-and-carl-icahn-meetup-energizes-gamestop-bulls-amid-yet-another-bear-market-rally/)). Netflix produced a full-length documentary against Herbalife. And GameStop inspired multiple films –– notably including [Dumb Money](https://www.dumbmoney.movie/) (for the bulls) and and [This Is Financial Advice](https://www.youtube.com/watch?v=5pYeoZaoWrA) (for the bears). The FBI and federal prosecutors investigated Ackman for market manipulation (["Prosecutors Interview People Tied to Ackman in Probe of Potential Herbalife Manipulation"](https://www.wsj.com/articles/prosecutors-interview-people-tied-to-ackman-in-probe-of-potential-herbalife-manipulation-1426196822)). And the SEC similarly investigated Ryan Cohen (["Ryan Cohen Said To Be Under SEC Scanner Over His 'Sketchy' Bed Bath & Beyond Trades"](https://www.benzinga.com/news/23/09/34354521/ryan-cohen-said-to-be-under-sec-scanner-over-his-sketchy-bed-bath-beyond-trades)). After five years, Ackman apparently exited his position –– losing hundreds of millions of dollars. Supposedly, GameStop short sellers also closed their positions (["Melvin Capital, hedge fund targeted by Reddit board, closes out of GameStop short position"](https://www.cnbc.com/2021/01/27/hedge-fund-targeted-by-reddit-board-melvin-capital-closed-out-of-gamestop-short-position-tuesday.html)). The book [When the Wolves Bite: Two Billionaires, One Company, and an Epic Wall Street Battle](https://www.bizjournals.com/newyork/news/2018/04/26/book-chronicles-ackman-icahn-herbalife-rivalry.html) by Scott Wapner describes the Herbalife story. [The Antisocial Network: The GameStop Short Squeeze and the Ragtag Group of Amateur Traders That Brought Wall Street to Its Knees](https://www.hachettebookgroup.com/titles/ben-mezrich/the-antisocial-network/9781538707555/) by Ben Mezrich describes the GameStop story.

AnimorphFan1996 9 months ago • 100%

As the Energy (named by @jersan) has migrated between social media platforms, various moderators have tried to control and censor it. How can we prevent this? Open source software relies on The Tentacles of Evil test. This says that even if the developer turns evil or gets bought out, then their software must still remain open source.

Imagine a future whether the moderation of this community turns evil. Let's preemptively break our own containment by linking in the sidebar to related communities controlled by independent parties (such as !theppshow@lemmy.world as @SubDRSive mentioned). If the links are removed, then they are the canaries in the coal mine, showing that this community is compromised. If the links remain, then the Energy can move freely.

www.youtube.com

www.youtube.com

Related Videos: * [The Apes and Wall Street](https://lemmy.whynotdrs.org/post/340778) * [How Redditors Exposed the Stock Market](https://lemmy.whynotdrs.org/post/310203)

AnimorphFan1996 9 months ago • 100%

Thanks for the heads up! The 663 upvotes on the Reddit post show that even a one-sentence edit in Wikipedia can get noticed!

I'm always looking for opportunities to break the containment, so I sent the following message to /u/ShredManyGnar:

I just read your post "I do not concede defeat" on r/superstonk about Cede and Company. We're working on a project to edit Wikipedia to provide the facts about DRS and GameStop. For more information, please check out the following post on Lemmy:

AnimorphFan1996 9 months ago • 100%

I can relate to your resentment. The stock market feels like a con, and that's because it is. I ask people, unrelated to this community, "Do you think it's rigged?" Invariably the answer is yes. What do you think can be done? Do you really think selling will help?

AnimorphFan1996 9 months ago • 100%

Nobody wants another hedge fund –– we want to update the system so it works for everyone. 💜

www.youtube.com

www.youtube.com

In particular, listen to the section "Direct shareholdings vs. direct stock purchase plans" at 6:59. For related videos, please see ["Paul Conn - AMAs, Appearances, and Transcripts"](https://lemmy.whynotdrs.org/post/73298) posted by [@Chives](https://lemmy.whynotdrs.org/u/Chives) four months ago.

AnimorphFan1996 9 months ago • 100%

Everybody has a hobby. Some people like building model trains, bird watching, dancing on TikTok... We like investigating corruption in the stock market. Lemmy is big enough for all of us. 💜

AnimorphFan1996 9 months ago • 100%

Do you think that a shorter securities transaction settlement cycle could require additional shares to be held at the DTC for operational efficiency? In other words, to move the drive-thru line faster, you store more burgers under the heat lamp?

youtu.be

youtu.be

This episode of the [Bankless podcast](https://www.bankless.com/) about crypto games reminded me of the [GameStop NFT Beta](https://nft.gamestop.com/) because it shows the potential for gaming to go beyond brick and mortar. See also the post ["Protocol: Gemini - BLACKPAPER 2.0"](https://lemmy.whynotdrs.org/post/474001) by [@jersan](https://lemmy.whynotdrs.org/u/jersan) about crypto gaming in augmented reality. And the article ["Overstock Short Sellers Fall Short as Judge Gives Digital Dividend Claims Short Shrift"](https://www.coindesk.com/markets/2020/09/29/overstock-short-sellers-fall-short-as-judge-gives-digital-dividend-claims-short-shrift/) about how Bed Bath & Beyond (then Overstock) used a crypto dividend to mitigate short selling. - 00:00:00 Intro - 00:04:45 Intro To Crypto Gaming - 00:11:26 How Has Crypto Gaming Evolved? - 00:15:05 Casual Vs AAA Games - 00:18:37 The Current Gaming Experience - 00:23:26 What Benefits Come From Blockchain? - 00:30:13 Best Argument Against Crypto Gaming? - 00:40:20 How Far Can This Go? - 00:45:38 iOS and Taxes - 00:50:02 Dealing With Regulators - 00:53:52 Choosing a Chain - 00:59:41 Are Traditional Studios Coming? - 01:02:18 What's An On-Chain Game? - 01:07:11 Blockspace - 01:13:49 Can This Pump Our Assets? - 01:16:35 Closings and Disclaimers []() []()

www.youtube.com

www.youtube.com

AnimorphFan1996 10 months ago • 100%

🍻

AnimorphFan1996 10 months ago • 100%

I like the idea of giving the DTCC the scrutiny that a monopoly deserves. Consider the political cartoon "The Bosses of the Senate" by Joseph Keppler in 1889. It shows diminutive senators at their desks in congress supervised by towering and obese captains of industry. Industry owns congress –– but who owns industry? Cede and Company.

(I bet that federated Lemmy users would like this cartoon. And it is in the public domain. @Zuberi Do you have any meme ideas?)

AnimorphFan1996 10 months ago • 100%

Great chart –– it lets people make their own judgments based on the facts! I will give the bull case, and if you disagree, then feel free to give the bear case. For the latest quarter, stockholder equity is $1.3 billion, and net loss is $3 million. $1.3 billion / ($3 million / year) = 433.3 years. This is sufficient runway to turn the company around.

AnimorphFan1996 10 months ago • 100%

approximately 75.4 million shares of our Class A common stock were held by registered holders

Nobody is selling –– another quarter of diamond hands. 💎👊

AnimorphFan1996 10 months ago • 100%

EPS: -0.01

Not bad.

www.yalelawjournal.org

www.yalelawjournal.org

"Subsection II.B. The Paperwork Crisis and the Birth of the NSCC and DTC" (pages 127 - 131) relates to ["Taking Stock, Episode 14: The Birth of the DTC"](https://lemmy.whynotdrs.org/post/467096). "When we think of securities markets, we imagine crowded trading floors, electronic trading screens, brash cable-news hosts, and titans of industry ringing the opening bell at the New York Stock Exchange (NYSE). But the institutions that really move money on Wall Street reside around the corner –– quite literally –– at 55 Water Street. This is the home of DTCC and its twin subsidiaries, NSCC and DTC. Today, NSCC is America's only securities clearinghouse, and DTC its only securities depository." (pages 122 - 123) "NSCC guarantees that funds will be delivered to the seller and that purchased securities will be delivered to the buyer. If a counterparty defaults, NSCC will first use the collateral that the defaulting party posted as margin against its outstanding obligations. If those funds prove insufficient, NSCC can tap into a dedicated default fund financed by mandatory contributions from market participants as a condition of their membership. NSCC employs similar mechanisms to guarantee the delivery of purchased securities." (page 131) "There is relatively little publicly available information about these regional clearinghouses and depositories. Other than the descriptions that follow, it is not known how they were governed, how much the regional exchanges invested in them, or how much money they made or, more likely, lost." (page 133) "Importantly, the existence of these regional players prompted Congress to list 'competition among ... clearing agencies' as one of the primary goals of the newly created Section 17A." (page 133) "As it encouraged the development of a 'National Market System,' the SEC repeatedly pointed to Congress's desire to facilitate competition among the clearing agencies. On multiple occasions, the SEC even stated that 'clearance and settlement is not a natural monopoly.'" (page 134) "The SEC's emphasis on promoting competition was also reflected in the concerns among market participants and other regulators that NSCC and DTC would abuse their growing market power. In the late 1970s, the SEC received comments from the regional clearinghouses and DOJ's Antitrust Division challenging the SEC's approach to the National Market System on the ground that it was anticompetitive and would open the door for NSCC and DTC to obtain monopolies." (page 134) "Yet, just twenty years after Congress amended the Securities Exchange Act to create the National Market System and only fifteen years after the SEC first granted registration to NSCC, DTC, and other clearing agencies, all the regional players had halted their clearing and depository businesses and transferred their operations to NSCC and DTC." (page 137) "Predictably, once DTCC acquired complete control over U.S. securities clearing and depository markets, evidence began to emerge that it might have been abusing its dominant position." (page 155) "They did so by imposing high fixed costs to connect to the new market infrastructure, by allowing NSCC and DTC to dictate the direction and pace of innovation, and by preventing the regional players from differentiating their products and services from those of their larger competitors." (page 138) "The NYSE, Amex, and NASD appear to have used this position to advance their broader business interests. For example, in 2006, DTC proposed a rule that made it extremely difficult for nonmember transfer agents, regional exchanges, and brokers that were not members of the NASD to hold securities recorded on DTC's book-entry system." (pages 155 - 156) "In effect, the proposed rule, which the SEC approved in amended form, forced these firms to choose between opening an account with DTC, creating their own infrastructure for electronically recording securities ownership, or simply exiting the marketplace." (page 156) "This bleak calculus prompted at least one competitor to object that DTC was 'seeking to become a de facto regulator of the entire transfer agent industry' and to argue that DTC was using its position as 'a monopoly [to] engage[] in predatory, anti-competitive conduct with respect to its direct competitors.'" (page 156) Awrey, D., & Macey, J. C. (2022). Open access, interoperability, and DTCC’s unexpected path to monopoly. Yale Law Journal, 132(1), 96–170.

AnimorphFan1996 10 months ago • 100%

National Best Bid and Offer (NBBO) is a regulation by the United States Securities and Exchange Commission that requires brokers to execute customer trades at the best available (lowest) ask price when buying securities, and the best available (highest) bid price when selling securities, as governed by Regulation NMS.

AnimorphFan1996 10 months ago • 100%

Thank you for your analysis!

AnimorphFan1996 10 months ago • 100%

I appreciate you dropping by from monero.town. We share a common goal of working towards a better financial system. 🤝

AnimorphFan1996 10 months ago • 100%

you don’t understand statistics [...] spend a little time reading [...] It should be glaringly obvious [...] utterly devoid of meaning [...] Posting random pages [...] just kinda sad [...] you lack basic statistical literacy

You are being rude, and this idiosyncrasy is significant. I will try to explain for you in simple terms. Although the price of a stock varies over time, at any given time, the price should be approximately the same across brokers. (And for tokenized stocks to substitute for non-tokenized stocks, then their prices also need to correspond.) When I buy a stock on Charles Schwab, then the price should be the same as when you buy the same stock on Fidelity. If you get a different price from me, higher or lower, then the price of the stock is wrong. No Bonferroni correction necessary. It doesn't matter whether this happens for every stock or just one idiosyncratic stock. If the price is different, then the price is wrong.

AnimorphFan1996 10 months ago • 100%

The sources and methods are laid out in the thesis. The author, his advisor, the people who upvoted this, and I thought that this idiosyncrasy was meaningful. On the other hand, some sarcastic ding-dong on the Internet disagrees...

AnimorphFan1996 10 months ago • 100%

you don’t understand statistics and probability

Dude, the post is a master's thesis from Ghent University. It is at least as statistically rigorous as any comment on Lemmy.

AnimorphFan1996 10 months ago • 100%

AnimorphFan1996 10 months ago • 100%

As AQS’s executives made the rounds of the stock lending industry and meeting with the organizations that would be part of the re-engineering of critical market infrastructure, one such institution openly stated that the AQS plan, “[sounded] great, but who’s going to start [your] car in the morning?”

Good stuff –– you should post this!

AnimorphFan1996 10 months ago • 100%

Good news! Both of the revisions are still standing as of this afternoon:

AnimorphFan1996 10 months ago • 100%

I just purged the server-side cache for the article Cede and Company. If you still don't see the revision, then you can also try bypassing your client-side cache.

Please see the attached image. "Only two out of twenty tokens have correlations beneath this threshold, namely McDonald's Corporation and Gamestop Corporation with respective correlation coefficients of 0,79 and 0,93." Buyse, J. (2021). Impact assessment of digital assets on securities markets [Universiteit Gent]. https://libstore.ugent.be/fulltxt/RUG01/003/010/051/RUG01-003010051_2021_0001_AC.pdf

I am continuing with [the project to edit Wikipedia articles about GameStop and DRS](https://lemmy.whynotdrs.org/post/300439). I expect that this will take both vigilance and good citations. For example, in the article [Cede and Company](https://en.wikipedia.org/wiki/Cede_and_Company), I wrote, "Appropriately, the word 'cede' means to 'give up (power or territory)' because investors give up their stock and companies give up their shareholders to an intermediary." I cited ["Rise and effects of the indirect holding system system: How corporate America ceded its shareholders to intermediaries"](https://lemmy.whynotdrs.org/post/460206). How you can help: - Post ideas of articles to edit - Post citations to [reliable sources](https://en.wikipedia.org/wiki/Wikipedia:Reliable_sources) - [Watch articles](https://en.wikipedia.org/wiki/Help:Watchlist) for deletion of key facts! Challenge: Get the word 'DRS' to stay in the article [GameStop short squeeze](https://en.wikipedia.org/wiki/GameStop_short_squeeze).

What if you didn’t have to wait days for trades to clear, pay exorbitant hidden fees to your broker, or worry about holding counterfeit stock? Capital markets work, but they’re incredibly inefficient. A few powerful institutions: - control stock lending and margin, generating fake shares en mass; - systematically disenfranchise global investors from buying stocks; and - through manipulative systems, ultimately cost investors over $3.75T / year. Transfer agents can uproot industry behemoths by undermining their grasp on capital markets. In particular, all brokers are commingled as but a single investor on the books of public companies. Public firms hire a “transfer agent” to maintain these investor records. The stock transfer agent industry has consolidated to four major providers over the past few decades. Service amongst them has dwindled while prices skyrocket. Issuers are not satisfied. Old transfer agents force book-entry stockholders to print complex paperwork, travel to an approved bank, present identification documents, wait for a tedious banker review, snail mail everything, and hope for an unhurried account statement or check back. We think significantly more investors would use transfer agents if their trading experience was digital, streamlined, and came with easy bank connections. This is possible since private stock sales on your own behalf aren’t regulated as stringently as traditional capital markets. Transfer agents haven’t offered a trading interface because old market technology required centralized coordination. Securities laws disallow transfer agents from this. But decentralized ledgers and particularly the Stellar Decentralized Exchange (“SDEX”) let book-entry investors match trades from anywhere with zero middlemen. This is the future of investing. For more information, please see the paper ["Block Transfer."](https://blocktransfer.com/.well-known/yellowpaper.pdf)

[Critics of the DRS movement have called us conspiracy theorists, cargo cultists, etc.](https://sh.itjust.works/comment/5864581) Taking this as constructive criticism, I thought I would start posting some relevant scholarly papers. The following paper discusses DRS, Cede and Company, an SEC investigation, the stockholder list, shareholder voting, and the DTCC. The author, David Donald, wrote his dissertation on this topic, so his knowledge is up there with Susanne Trimbath. > The Rise and Effects of the Indirect Holding System: How Corporate America Ceded Its Shareholders to Intermediaries > > David C. Donald > > This paper explains how the choice of the indirect holding system for securities settlement forced U.S. issuers to cede their shareholder data to intermediaries. > > Part I describes the law applicable to the transfer of certificated securities. > > Part II describes how the paper-intensive process of transferring certificated securities led to a market failure in the 1960's. It further shows how the indirect holding system was seen as a temporary, second-best solution pending the dematerialization of shares and improvements in communications technology. In the mean time, the effects of separating beneficial and record ownership led to an expensive and inefficient process of shareholder communication and voting. > > Part III examines this process, whose inefficiency offered service providers the profitable niche industry of assisting issuers to distribute proxy materials through and around extensive chains of intermediaries. > > Part IV explains how, when law and technology had developed sufficiently to allow a return to a system of direct issuer-shareholder relationships via a direct registration system, intermediaries acted rationally to absorb DRS into the DTTC system, and continue to enjoy their central role between issuers and shareholders. This Part also demonstrates how a truly effective direct registration system could provide the transparency necessary to address problems such as "empty" voting and could arguably spread the costs of securities settlement more equitably through broader- based netting, rather than pushing them downstream. > > Part V argues that although the indirect holding system and its negative effects are no longer necessary, a combination of unawareness and interest serves to perpetuate a perceived need for issuers and shareholders to cede their ownership/governance relationship to a custodian utility, which then offers to put them back into contact, for a fee. [Mirror on diyhpl.us](https://diyhpl.us/~bryan/papers2/paperbot/bcd1dfcf9b0f439efc64f7d43389c29a.pdf) [Mirror on publikationen.ub.uni-frankfurt.de](https://publikationen.ub.uni-frankfurt.de/opus4/frontdoor/deliver/index/docId/590/file/ILF_WP_068.pdf) [Mirror or papers.ssrn.com](https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1017206)

deoccupywallst.com

deoccupywallst.com

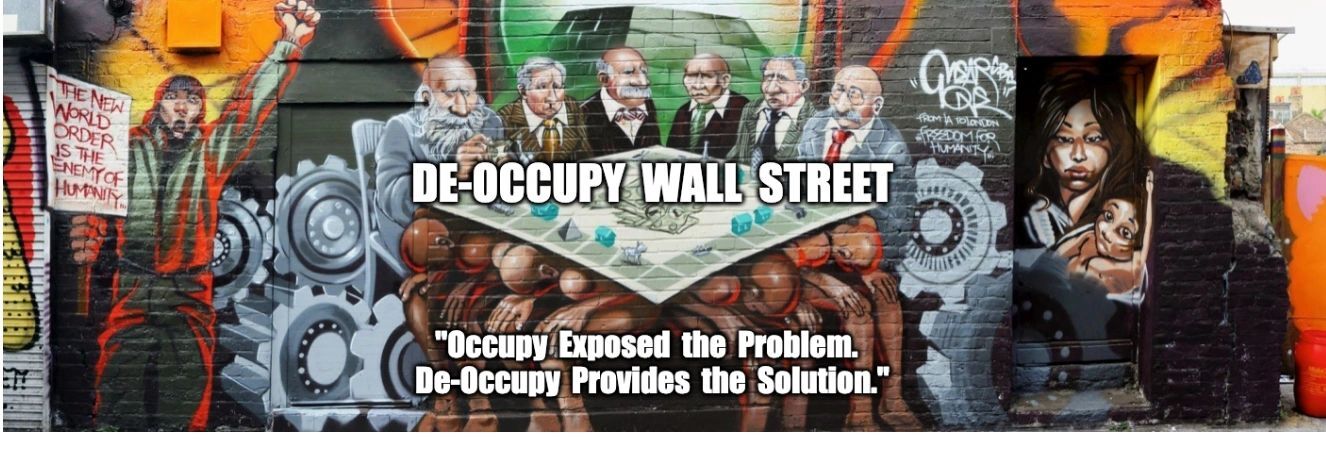

"Wall Street uses money from stocks that regular people have invested in the stock market to hold the 99% down while propping up the 1%. That allows Wall Street to control the media, create division, and hand pick politicians who enforce and create laws that enable Wall Street to widen the wealth gap. The current system is a feedback loop where the more Wall Street takes from you, the more they can fund their ability to take more and more." "There is a solution, however, and that's by having the American public remove their stocks out of Wall Street's name, and put them in their own. This can be done with just a single phone call to your broker (or advisor), but that secret is so well hidden that no one knows about it nor what it's called. It's called the Direct Registration System (DRS), and by registering your stocks in your own name, we can restore the American dream and take back what is rightfully ours from the system that has held us down for decades." For more information, please see the website [De-Occupy Wall Street](https://deoccupywallst.com/).

citadelair.net

citadelair.net

upsidechronicles.com

upsidechronicles.com

**Something big is lurking in Wall Street’s dark pools** BY JACK TAZMAN DECEMBER 27, 2022 To the retail investor, dark pool history and current activity is every bit as unsettling as it sounds. The stock market is a place where the public has access to owning a little slice of the American economy by buying fractional ownership of companies. Once a company goes public, their financials and ownership composition are subject to reporting requirements and regulation. …Right? If the above statement sounds reasonably accurate to you, you are probably going to get absolutely steamrolled as a retail investor. When it comes to trading what you don’t know will almost certainly hurt you. Remember that as a rule, complexity and obscurity are the nukes in Wall Street’s arsenal of advantages over retail investors. Wall Street spends top dollar fighting any attempt to bringing transparency to their practices or strongholds on power and control. Upholding this rosy but outdated perception of the market is just one of the many tools in their box. In this continuation of Upside Chronicles‘s Wall Street toolbox of market manipulation, we’re diving into the murky waters of dark pool trading. **What are dark pools?** Dark pools are marketplaces where Wall Street can make trades and execute strategies outside of the public eye. The general public does not have direct access to dark pools, which are also referred to as alternative trading systems (ATS). Those that do have access to their murky waters are able to trade privately and directly with other participants. While dark pool volume is reflected “on the tape,” whether the trade was a buy or sell is not. Dark pools do have some reporting requirements. Every week, the total ATS activity is listed by security on FINRA’s website. However, by the time the data goes public, it is already out of date. Remember, this is coming from the industry that has the infrastructure to check multiple exchanges for prices in nanoseconds and execute billions of trades per day. But when it comes to basic transparency reporting….30-day latency. Retail investor orders often get filled in dark pools through the payment-for-order-flow business model. In the GameStop run up earlier this year, it was revealed that Robinhood was routing its order flow to marker maker Citadel for fulfillment. That means Citadel essentially had exclusivity in processing Robinhood investor orders. The way a healthy public market would work is that all participants – regardless of how deep their pockets – would be able to see the same pre-trade data, also known as the order book. This information is key to calibrating the buy and sell pressure on stocks to determine where their price is heading. That is exactly why it is hidden from public view. **Rule 19c-3: There are no rules for Wall Street** True to their nature, dark pool trading slithered into legal standing through a seemingly innocuous enough, cleverly named ‘Rule 19c-3.’ In the Federal Register entry regarding the adoption of this rule, the SEC (yes, the commission tasked with regulating the markets) referred to it as a ‘limited proposal.’ For all the grandstanding Wall Street does decrying regulation, Rule 19c-3 is one Wall Street never complains about. That’s because it’s not really a ‘rule’ insomuch as an override of regulation pertaining to basic market transparency and fairness. Of course, those rules still apply to everyone else — the more money you have, the more of the full picture you get to see. Prior to the passage of Rule 19c-3, trading in public companies had to be done…well, publicly. Dark pools were illegal between 1933–1978 under the Securities Act of 1933, passed during the Great Depression after the stock market crash of 1929. There was significant opposition to the passage Rule 19c-3, which SEC defines as a ‘regulatory measure.’ Paradoxically, the “rule” actually reverses a real regulatory measure. Pointing out the obvious, the legalization of dark pools for big players would leave small brokerages and retail investors in the dark about what was truly happening in the market. These concerns were overruled in favor of the Commission’s belief that giving big market players exclusive privacy privileges would “limit the expansion of the anticompetitive effects of off-board trading restrictions.” In other words, giving big players exclusive “privacy privileges” makes for a more competitive market. And that’s how dark pools became legal again. **The ‘theoretical’ justification for dark pools** Today, when the obvious advantages dark pools give to big Wall Street players is brought into question, the excuse mill they use to justify them falls into the buckets of: 1. There may be times where large transactions need to be executed privately to avoid rocking the stock price. Their favorite example to give is say, a former CEO with a large holding decides to retire and sell their stake. 2. They need privacy to execute “proprietary trading strategies” (and fraud, too.) Of course, this directly contradicts their defenses of short selling‘s existence. It’s hard to argue that dark pools don’t drain liquidity from the market. Cushioning an insider sell off also interrupts “efficient price discovery.” Perhaps they mean it in the same playful way the word “Rule” is used in “Rule 19c-3.” **Dark pools hide the big picture about a stock’s true price** Dark pools obscure the real price of shares. Any given stock could have massive orders queued up in the order book, away from public view. The prices retail investors see on the ticker tapes running across the screens of CNBC and Yahoo Finance generally aren’t truly reflective of active supply-and-demand pressures. Imagine going to a dealer to buy a truck. When you pull up, you see two trucks in the parking lot. The salesman says these are the only trucks they have in their inventory. The last dealer you visited only had one truck at about the same price. It seems a little expensive, but you go ahead and buy the truck. After the paperwork is signed, you are led to the other side of the building. There, through a crack in massive blackout curtains that cover floor-to-ceiling windows, you see another lot packed with trucks. Moreover, the prices painted on the windows are thousands less than what you just paid. The inventory on the back lot is only available to people in tax brackets much higher than yours. Dark pool trading is a bit like that, except you’ll never see the back lot. The very next day, all the trucks in the back lot are sold for $10,000 less than what you paid. The resale value of your truck falls. Retail investors take note: The price you see on the ticker could very much be – and probably is – an illusion thanks to the SEC’s “regulatory measure,” Rule 19c-3. Much like short selling, dark pools are one of the many ways Wall Street players can manipulate the market and by extension, a large part of the American economy. **GameStop price action reflects dark pool price manipulation** Frustrated retail investors noted that despite months of numerous brokers reporting significantly more buy orders than sell orders, the prices of meme stocks like GameStop would fall. For much of 2021, Fidelity, the largest stock broker in the world, showed significantly more buy orders than sell orders, a trend that was mirrored by other brokers. Yet GME shares would still fall in price on these days. On 8/18/21, Fidelity’s buy-sell ratio on GME was 82% buy, 18% sell. The stock still fell by over 6%. Retail investors suspected buy orders were being handled in dark pools to distort ticker price. Especially considering n this trend repeated itself day after day for months on end. Despite significantly higher demand than supply, the net effect on the price was a downtick. Note: Orders reflect varying amounts of shares. This can happen if the sell orders were significantly larger than buy orders. Additionally, the ratio displayed above only reflects Fidelity’s buy-sell order ratio for the day. **Something is lurking deep in dark pools in 2021** #darkpools and #darkpoolabuse has been trending on Twitter for months. In the eleven quarters leading up to and through Q2 of 2020, the percentage of total shares traded in dark pools averaged around 17%. But Q3 of 2020 saw that figure shoot up to almost 50%. Of course, markets are dynamic, so anomalous spikes and drops happen. Yet Q4 2020 saw the 50% level sustained. Incredibly, instead of floating back down to Earth, it continued to escalate. The first quarter of 2021 saw a jaw dropping 74% of all shares traded handled exchanged in dark pools. In Q2, it headed back in the right direction, but still landed just shy of 70%. More than seventy percent of all shares that changed hands in the stock market at large in 2021 did so in dark pools. If this is the SEC’s idea of a ‘limited proposal’ that combats ‘anticompetitive effects,’ retail investors pinning their hopes to regulatory intervention shouldn’t hold their breath. **Massive volume increase** Interestingly, percentage of shares traded in dark pools isn’t the only thing ramping up. The number of shares traded in the market overall exploded. The ten quarters between Q1 2018 and Q2 2020 collectively averaged approximately 71 billion shares traded per quarter. The second quarter of 2021 saw over 500 billion shares change hands. That’s a 700% increase compared to the historical average, and of those trades, almost 70% was executed in dark pools. What is fueling the frenzied activity that Wall Street tries to frame retail for, (but can’t in this case considering 70% of the activity is happening in Wall Street insider exchanges) is the multi-trillion dollar question. If this doesn’t reflect market manipulation by Wall Street insiders and marker makers, then all securities regulations are about as “strict” as Rule 19c-3. And much like Rule 19c-3 states, the rule is that when it comes to Wall Street, there are no rules. **Clues in trade size** Total volume percent traded in dark pools aren’t the only metrics going bananas. Trade size has been showing some unusual fluctuations that are rapidly breaking from historical trends. A trade can contain one share, a thousand shares, or a million shares. In sync with the other exponential ramps from Q3 2020 onward, the trade size on public markets versus dark pool markets have also escalated. Firstly, the trade sizes on public exchanges have been trending downward. Between Q1 of 2018 and Q2 of 2020, the average size of trades executed on lit exchanges bounced around between the high 180s and low 200s. The cumulative average across that period came in at 196.4. However, starting in Q3 of 2020 onward, there was a sharp decline. For the most recent data reported to FINRA, which spanned the period between 04/02/2021–06/30/2021, the average shares per trade on lit exchanges fell to 152. Over the last four quarters (through 06/30/2021), the cumulative average shares per trade fell to 159.25 – a 19% decline. Strange considering the number of shares changing hands in the market at large was up 700%. But a 19% fluctuation is small potatoes compared to what’s going on in dark pools over the same period. Meanwhile, back in the dark pools, the trend is shifting sharply in the opposite direction. The average dark pool trade size for the ten quarters leading up to Q3 of 2020 clocked in around 7,350. But in Q3 2020, yet another exponential ramp started. The last four quarters’ average weighed in at just shy of 26,000 per trade – a staggering 350% increase. It peaked in Q1 of 2021 — the prime quarter of meme stock chaos — at almost 36,000 shares per trade. **Swim with caution** This year has been a good one for the stock market. As of the time of this writing, the NASDAQ is up almost 18% this year, the S&P 500 has clocked just over 20% gains, and the Dow Jones is up almost 14%. And yet, with a hard majority of the market’s activity hidden from view, something just doesn’t seem right. There must be some impetus for this extreme ramp in the need for discretion and frenzy in behind-the-curtain trading. The question is: What? The truth is, no one can know for sure. Wall Street has built in cover with “regulatory measures” and “limited proposals” that hide more than 70% of the ‘public market’s’ trading activity from view to everyone but them. The best we can do is take the information we do have, knowing that this is what the big players have “let” us know. From there, perhaps a strategic place to start is understanding the depth of what we don’t know. **Jack Tazman** Jack Tazman is a Baltimore, Maryland native. He attended Washington University where he studied political science. Since then, he worked as a writer for various national news organizations specializing in politics and policy. He now resides in New York City as a freelance writer and political consultant.

www.youtube.com

www.youtube.com

One-minute clip from *The Problem with Jon Stewart Podcast*. [Mirror on Invidious](https://vro.omcat.info/watch?v=gy7RpMiRfto) Related: [How Redditors Exposed the Stock Market (2022)](https://lemmy.whynotdrs.org/post/310203)

Shower thought: The word 'cede' literally means to give up ownership. We ceded our stock to Cede & Co. They literally own 83% of the stock market. Time to take it back! (Please see the attached image.)

www.youtube.com

www.youtube.com

The highest scoring post on our server is ["Some truth to this, I'd say"](https://lemmy.whynotdrs.org/post/113692) a quote from Jon Stewart posted by [@MoozooZ](https://lemmy.whynotdrs.org/u/MozooZ). I thought that you might also enjoy watching "How Redditors Exposed the Stock Market" from the TV show *The Problem with Jon Stewart*. [Mirror on Invidious](https://invidious.garudalinux.org/watch?v=bP74RBTE8kI)

www.youtube.com

www.youtube.com

[Mirror on Invidious](https://invidious.garudalinux.org/watch?v=6dHDTUQWYr0)

GameStop Stock: Don't Count on Ryan Cohen Selling His Shares According to GameStop's new CEO, he will either turn the company around or go down with it. BERNARD ZAMBONIN OCT 4, 2023 5:23 AM EDT Ryan Cohen, GameStop's new CEO, owns about 12.10% of the company's shares and is determined to lead the company to profitability. GameStop has been implementing cost-cutting measures and reducing operating expenses, while Ryan Cohen's personal investment and commitment signal his determination to turn the company around. Ryan Cohen Is GameStop's New CEO It has been quite a journey for Ryan Cohen and GameStop. On September 28, the company's board of directors announced that Cohen had been appointed president and chief executive officer. In their statement, they included the interesting tidbit that Cohen will not receive any salary for taking on this new role. Ryan Cohen, who used to be the CEO of Chewy and is GameStop's largest individual shareholder, owns approximately 12.10% of the company's total shares through his holding company, RC Ventures. Back in 2021, he joined GameStop's board and eventually assumed the position of chairman. More recently, in June of this year, Cohen took on the role of executive chairman following the departure of GameStop's former CEO, Matt Furlong. The Survival Memo In his first communication as CEO, Cohen sent a memo to GameStop employees titled "Survival." In the document, he emphasized the importance of practicing frugality given the challenging situation that GameStop's business currently faces. Cohen wrote: "It is not sustainable for GameStop to operate a money-losing business. The mission is to operate hyper-efficiently and profitably. Our expense structure must allow us to endure any adverse scenario. Whether it's a difficult economy or revenue deceleration from shrinking software, we must be profitable. Our job is to make sure GameStop is here for decades to come. Extreme frugality is required. Every expense at the company must be scrutinized under a microscope and all waste eliminated. The company has no use for delegators and money wasters. I expect everyone to treat company money like their own and lead by example. "Prospering in retail means survival. If we survive, we stay in the game. Survival is avoiding the deadly sins that often lead retailers to self-destruct. This is usually a result of the following — buying bad inventory, using leverage, and running expenses too high. By avoiding these self-inflicted mistakes and focusing on the basics, GameStop can be here for a long time. "I expect everyone to roll up their sleeves and work hard. I'm not getting paid, so I'm either going down with the ship or turning the company around. I much prefer the latter. "It won't be easy. Best of luck to us all." GameStop is on track for its fifth consecutive year without turning a profit. As shown in the table below, the company has consistently maintained high operating expenses, but this hasn't translated into greater efficiency in its retail operations. Ryan Cohen's letter implies that he perceives there are corporate inefficiencies at work here. His memo could serve as a warning to higher-ranking individuals who might fall under the category of "delegators and money wasters." Over the past year, GameStop has reported approximately $1.61 billion in selling, general, and administrative (SG&A) expenses, compared to $1.47 billion in the previous 12 months. Throughout the year, the company has implemented a cost-cutting strategy and closed stores in Europe as part of its efforts to achieve profitability. Since the beginning of the year, GameStop has progressively reduced its SG&A expenses, resulting in significant improvements in its operating income. It's worth noting that GameStop currently maintains a strong cash position, boasting a balance sheet of approximately $1.1 billion and virtually no debt. This financial strength provides the company with an extra cushion — particularly during times when profitability is lacking. While it's important to acknowledge that this financial situation may not be sustainable in the long term, GameStop appears to be relatively stable from a liquidity perspective. This also reduces the likelihood of the company resorting to equity offerings to raise additional cash, which would dilute its float. Putting His Money Where His Mouth Is Ryan Cohen seems to take his motto of putting his money where his mouth is quite seriously. In June of this year, Cohen purchased an additional 443,842 shares at an average price of $22.5 per share, which is approximately 30% above the current share price. This increased his ownership to 1.770 million shares, representing 12.1% of GameStop's total shares. In his recent memo, he emphasized that he is not receiving any compensation for his new role as a company executive, stating, "I'm either going down with the ship or turning the company around." Whether the new CEO will succeed in turning the company around remains to be seen. However, one thing is clear: GameStop shareholders can expect Ryan Cohen to remain committed and not abandon the ship anytime soon. (Disclaimers: this is not investment advice. The author may be long one or more stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not influence editorial content. Thanks for supporting Wall Street Memes.) BY BERNARD ZAMBONIN Co-producer of The Street's financial channels: Apple Maven, Amazon Maven and Wall Street Memes. Researcher and operations manager at DM Martins Research.